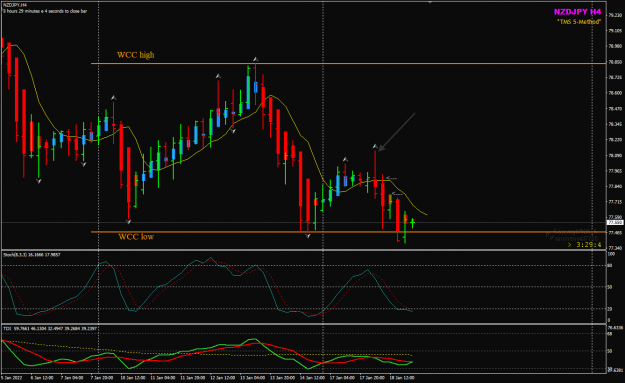

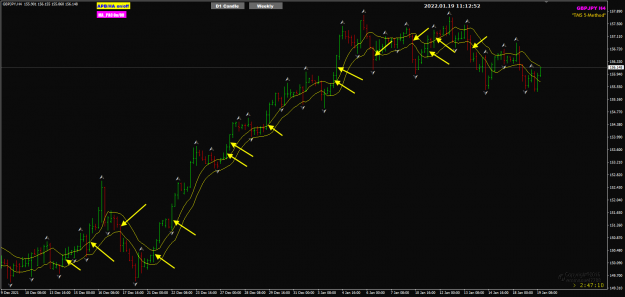

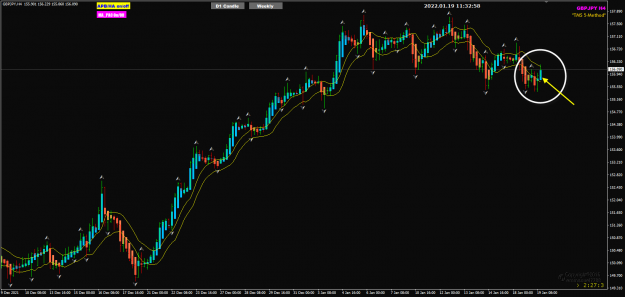

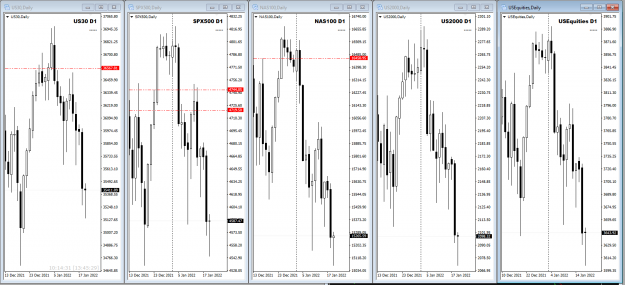

I could get used to this. In addition to the NZDJPY trade I posted about earlier I placed four others. I have just closed all of them. I'm still using a small lot size while I get used to it, but if I scale up I would have made around 3% for the day.

What I have done is trade a basket of trades. Instead of working with each one individually, I treat them as a collective, so if the total profit for my day (at or just before London market close) is anywhere above 2% I will close up for the day and sleep peacefully. I don't like holding active trades overnight if I can help it, so this approach is something that works for me very nicely. I have experienced this "basket trading" approach before with a system that generated a good number of trades in a day, say 5 to 7 trades. I have found that they would often all go into profit together but the longer I left them (to let my profits run) the more one of more would start losing steam and end up with a loss. When this happens it usually means that my total for the day almost never reaches what it was when they were all together.

What I have done is trade a basket of trades. Instead of working with each one individually, I treat them as a collective, so if the total profit for my day (at or just before London market close) is anywhere above 2% I will close up for the day and sleep peacefully. I don't like holding active trades overnight if I can help it, so this approach is something that works for me very nicely. I have experienced this "basket trading" approach before with a system that generated a good number of trades in a day, say 5 to 7 trades. I have found that they would often all go into profit together but the longer I left them (to let my profits run) the more one of more would start losing steam and end up with a loss. When this happens it usually means that my total for the day almost never reaches what it was when they were all together.