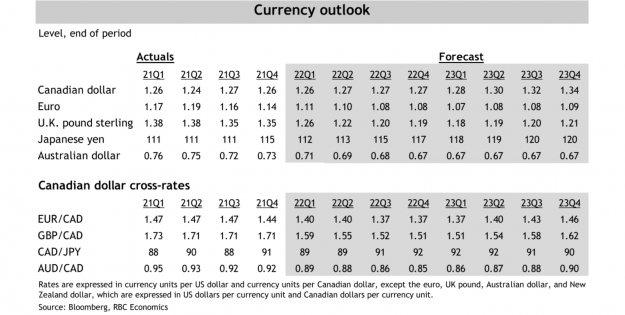

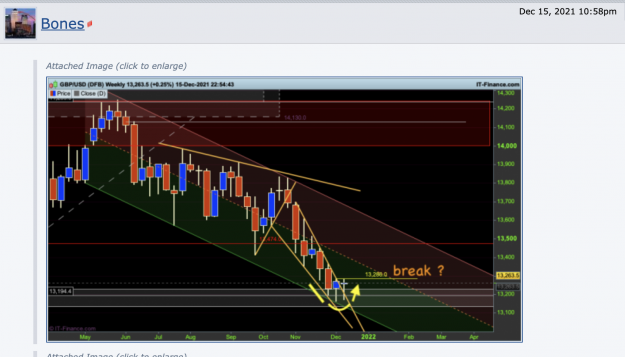

Disliked{quote} It could go through it easily, but it could also be a bull trap. I always look at the daily chart to determine entry or exit levels. I also consider what is on the economic calendar and the fundamental analysis.Ignored

You don't know because you don't ask.