Guys, I am a bit worried about the entry strategy.

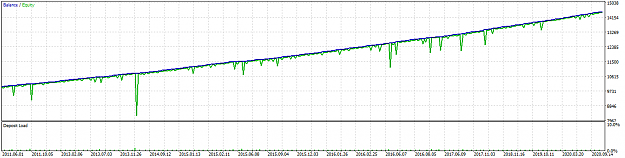

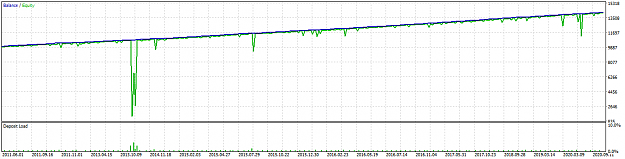

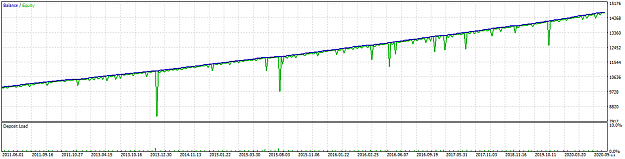

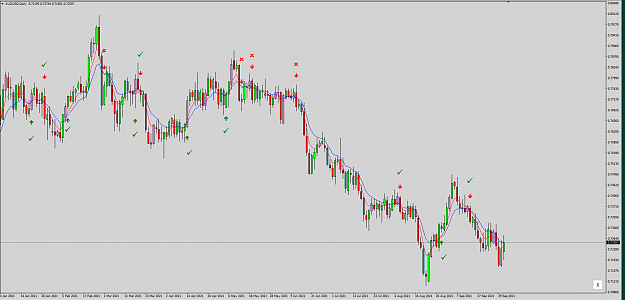

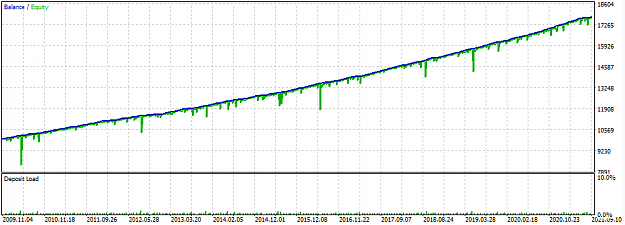

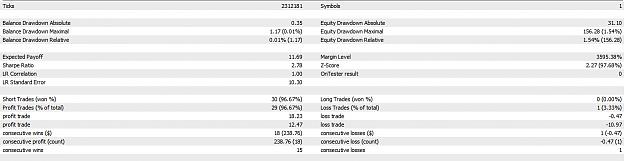

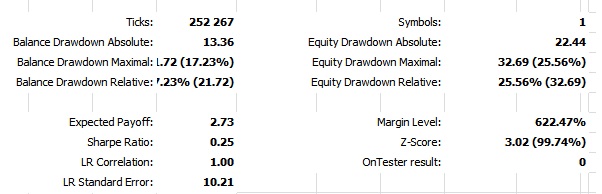

In version 1.35 I have added a EntryStrategy switch to choose between RetraceAfterLargeBar, TrendContinuationAfterLargeBar or RandomDirection. I have tested these settings on GBPCAD (see screenshots below):

All three strategies result in a growing equity curve (albeit with varying drawdowns). This makes me wonder whether there actually is a retracement after a large candle and this stategy does have an "edge" or only depends on the averaging down recovery.

In version 1.35 I have added a EntryStrategy switch to choose between RetraceAfterLargeBar, TrendContinuationAfterLargeBar or RandomDirection. I have tested these settings on GBPCAD (see screenshots below):

- The RetraceAfterLargeBar option is the original strategy where we assume the market will retrace after a large candle. For example, after a large bull candle we go short.

- The TrendContinuationAfterLargeBar option does the opposite. We assume the market will continue in the direction of the large candle. For example, after a large bull candle we go long.

- To test whether the entry criteria make any sense at all, I've also added a RandomDirection option that does just that. Randomly make either a Buy or Sell trade. Each time you run the Strategy Tester you will get different results with this.

All three strategies result in a growing equity curve (albeit with varying drawdowns). This makes me wonder whether there actually is a retracement after a large candle and this stategy does have an "edge" or only depends on the averaging down recovery.

1