When I started trading full time , I was in a good position. I began with a 25k account, but luckily for me I also started during the start of the great reccesion. Where every day was pretty much a trending day with large movements. So for 3/4 years it was easy to build your account quicklly. Thinking that you are going to make a living trading a 1k account, I've never pushed that, its foolish. But you can grow and build a 1k account to try a reach a place where you can think of trading full time(not easy).

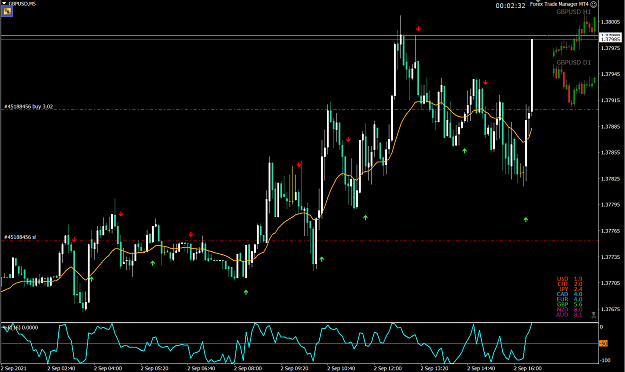

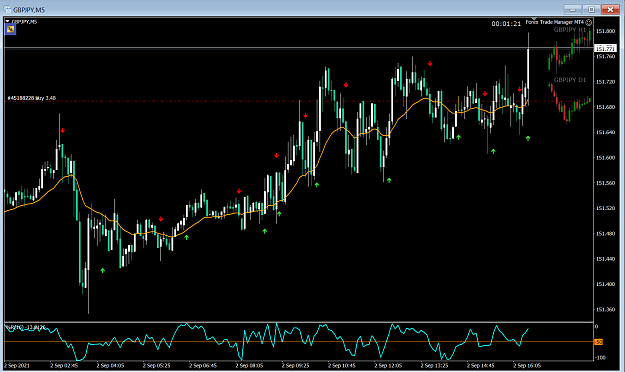

Risk/reward if you read the thread you know I place S/L's but do not place TP's most of the time. I do that for 2 reasons. One so if you get a strong trend you can pick up as much as possible. Second so that if trade stalls I'll take what profit I have and get out.

I don't believe in trailing stops and don't use them.

Risk/reward if you read the thread you know I place S/L's but do not place TP's most of the time. I do that for 2 reasons. One so if you get a strong trend you can pick up as much as possible. Second so that if trade stalls I'll take what profit I have and get out.

I don't believe in trailing stops and don't use them.

9