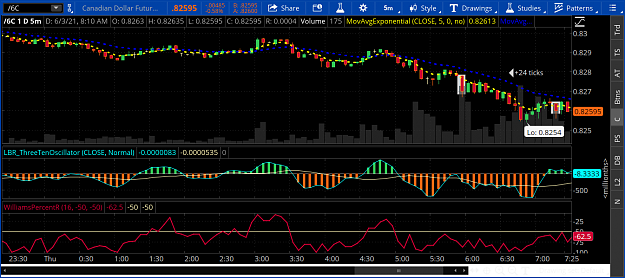

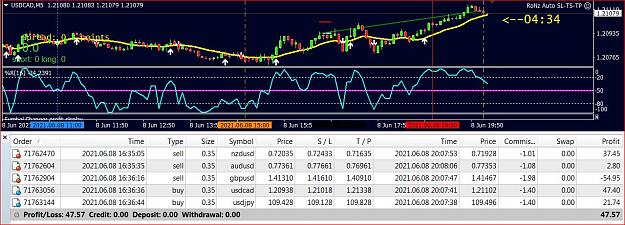

DislikedRocky, you can correct me if I'm wrong here but I think too many people are spending time focusing on indicators here. Truthfully, I don't even think you really use the indicators on your chart aside from maybe the moving average lol. I think people here are looking for more of a mechanical system when in fact there's a huge piece of discretional trading going on here from the many years you've spent trading... I think an argument can be made that the indicators besides the moving average are pretty useless and price action/ letting winners run...Ignored

And I do pay attention to all that I have on my charts. My point being that this thread is trying to get some people profitable. Yes too many will rely too much on indicators to be the solution. But there are some who are getting what I'm doing. At least they seem to get it.

6