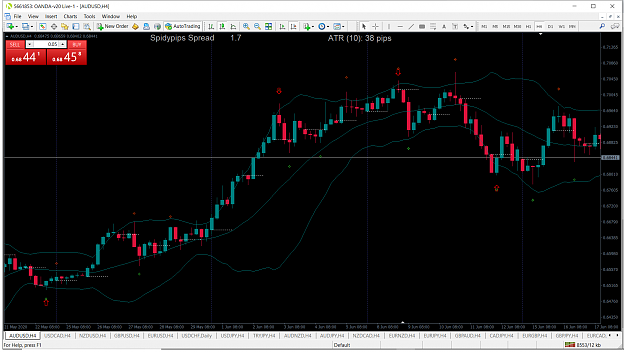

doing that actually paid off alot for me though im not consistently trading that setup. i trade only when i notice small setup candles where the risk to reward will pay off greatly. the chances of false signals are 50/50 from visual backtesting

1