DislikedHi JoanGuz, You have done great workI totally agree about the swap and unrealized drawdown. Do you think the bench should be adapted to average range ? Also here is an idea coming from a friend of mine : Exit rule #3 : Exit if account equity is less than highest equity * 95%. Reset the highest equity level after the exit. Regards.

Ignored

Thanks for the feedback and ideas!!

I do think that the bench should be dynamic, and the average range is a great place to start. I have manually changed the default (30) value, sometimes works great with a smaller value and sometimes with a bigger one. So, adding the range should be better to adapt to differet currencies with distinct volatility.

About Exit Rule #3, I added that exact rule in the weekend and the results were worse almost everytime, I say "almost" but I don't remember any pair that improved the results jeje. Look an example, first image is the system with default rules, and the second one is with Rule#3, parameters: EURSUD 2017-2021, Daily TF. Its worse because the rule realizes losses that will turn profitable ahead.

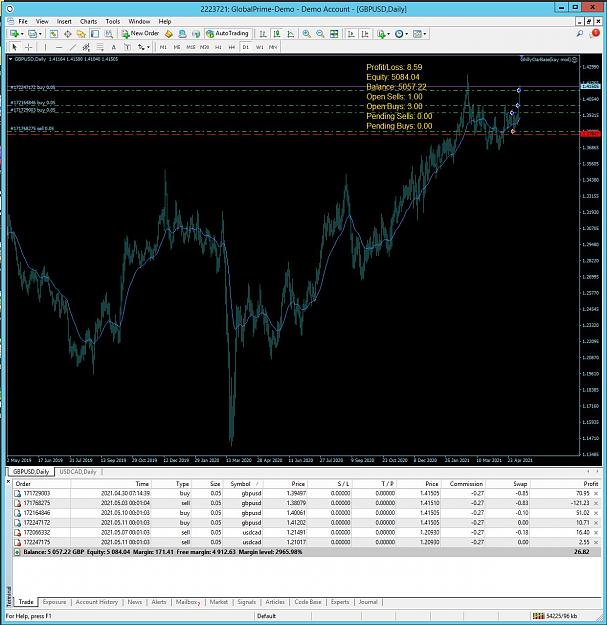

Right now I'm experimenting the system without rule #2, and looks super interesting! Obviously with smaller TimeFrames (to let the recovery happen faster) and smaller Lot Sizes, because the system sometimes opens a lot of trades before hitting the target. I'm doing that because I do think that we need a rule to exit when the system is flat and opening a lot of trades without going anywhere, but this rule sometimes closes losers with a terrible timing and realizing big drawdowns.

Regards!