Hello-

I have a question for the options gurus out there.

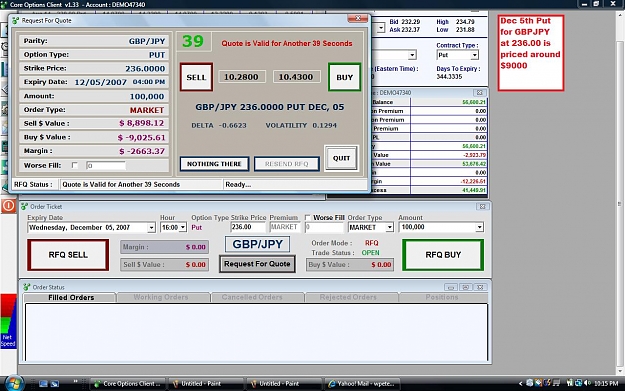

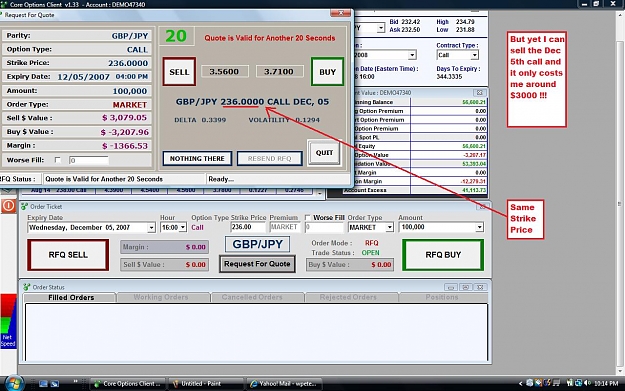

I cannot figure out why selling a call might cost less than buying a put.

Both options are priced at the same time, with the same strike price and the same expiration date (Dec 5, 2007) - see screenshots.

The only thing I can think of is that the put in this example is "deep in the money" - but selling the call at the same price is the same thing, in theory, as buying the put.

The only difference is that you may exercise the put now, but would probably not exercise the call now (in this example, please see screenshots).

So, I guess in this situation I would definitely sell the call, and save a lot of cash.

Can anyone explain this to me, or do I understand this... ?

I have a question for the options gurus out there.

I cannot figure out why selling a call might cost less than buying a put.

Both options are priced at the same time, with the same strike price and the same expiration date (Dec 5, 2007) - see screenshots.

The only thing I can think of is that the put in this example is "deep in the money" - but selling the call at the same price is the same thing, in theory, as buying the put.

The only difference is that you may exercise the put now, but would probably not exercise the call now (in this example, please see screenshots).

So, I guess in this situation I would definitely sell the call, and save a lot of cash.

Can anyone explain this to me, or do I understand this... ?