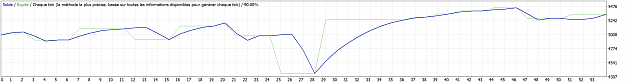

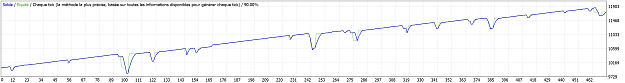

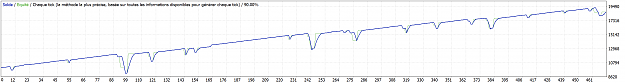

DislikedSomething that baffles me! Did a quick backtest using MT4 strategy tester (I know it's not completely reliable) using the following settings (Tradesize=0.05, ExitProfit=20, TargetStep=50, MaMethod=1) on USD5000 starting balance, on GBPUSD, USDCAD and EURUSD between 01/12/2019 to 10/03/2021. GBPUSD and USDCAD returned decent profits with decent max drawdown, but EURUSD returned a massive loss with big drawdown. What gives! GBPUSD: net profit = 1405.10 Max DD = 952.34 (18.16%) USDCAD: net profit = 719.39 Max DD = 803.48 (14.05%) EURUSD: net profit...Ignored

1