- Post #1,884

- Quote

- Apr 17, 2021 8:33am Apr 17, 2021 8:33am

- Joined Nov 2015 | Status: Member | 2,525 Posts

Practice makes a person perfect

- Post #1,885

- Quote

- Apr 17, 2021 10:29am Apr 17, 2021 10:29am

- Joined Sep 2015 | Status: Member | 2,224 Posts

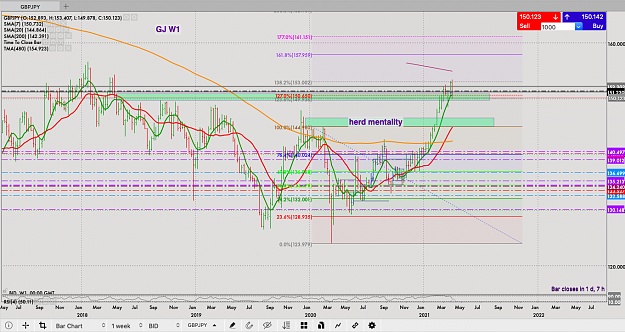

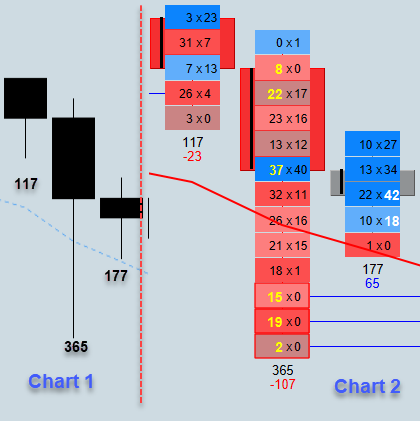

Trading thin liquidity at the boundary of the charts

- Post #1,886

- Quote

- Apr 17, 2021 11:18am Apr 17, 2021 11:18am

- Joined Nov 2015 | Status: Member | 2,525 Posts

Practice makes a person perfect

- Post #1,887

- Quote

- Edited 8:03pm Apr 17, 2021 5:51pm | Edited 8:03pm

- Joined Sep 2015 | Status: Member | 2,224 Posts

Trading thin liquidity at the boundary of the charts

- Post #1,888

- Quote

- Apr 18, 2021 12:02am Apr 18, 2021 12:02am

- Joined Nov 2015 | Status: Member | 2,525 Posts

Practice makes a person perfect

- Post #1,889

- Quote

- Edited 5:25am Apr 18, 2021 5:03am | Edited 5:25am

- Joined Sep 2015 | Status: Member | 2,224 Posts

Trading thin liquidity at the boundary of the charts

- Post #1,890

- Quote

- Apr 18, 2021 2:18pm Apr 18, 2021 2:18pm

- Joined Nov 2015 | Status: Member | 2,525 Posts

Practice makes a person perfect

- Post #1,891

- Quote

- Apr 18, 2021 3:22pm Apr 18, 2021 3:22pm

- Joined Jan 2016 | Status: Member | 1,804 Posts | Online Now

- Post #1,892

- Quote

- Apr 18, 2021 5:07pm Apr 18, 2021 5:07pm

- Joined Sep 2015 | Status: Member | 2,224 Posts

Trading thin liquidity at the boundary of the charts

- Post #1,893

- Quote

- Apr 18, 2021 9:07pm Apr 18, 2021 9:07pm

- | Membership Revoked | Joined Nov 2020 | 2,353 Posts

Real Trading is not gambling.

- Post #1,894

- Quote

- Apr 18, 2021 9:50pm Apr 18, 2021 9:50pm

- Joined Sep 2015 | Status: Member | 2,224 Posts

Trading thin liquidity at the boundary of the charts

- Post #1,895

- Quote

- Apr 18, 2021 9:51pm Apr 18, 2021 9:51pm

- Joined Nov 2015 | Status: Member | 2,525 Posts

Practice makes a person perfect

- Post #1,896

- Quote

- Apr 18, 2021 10:01pm Apr 18, 2021 10:01pm

- Joined Nov 2015 | Status: Member | 2,525 Posts

Practice makes a person perfect

- Post #1,897

- Quote

- Apr 18, 2021 10:29pm Apr 18, 2021 10:29pm

- Joined Sep 2015 | Status: Member | 2,224 Posts

Trading thin liquidity at the boundary of the charts

- Post #1,898

- Quote

- Apr 19, 2021 2:43am Apr 19, 2021 2:43am

- | Membership Revoked | Joined Nov 2020 | 2,353 Posts

Real Trading is not gambling.