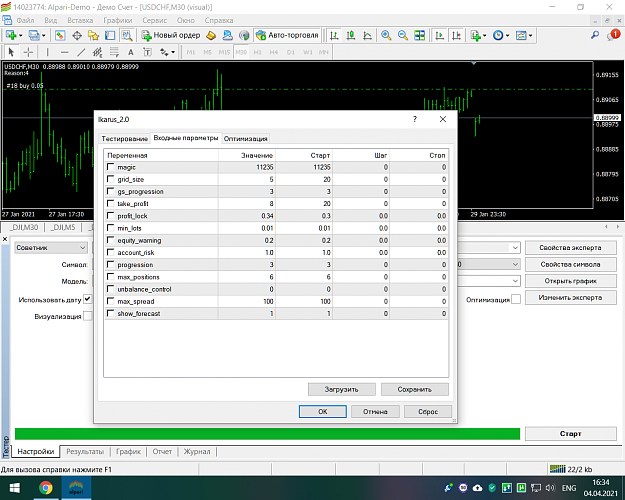

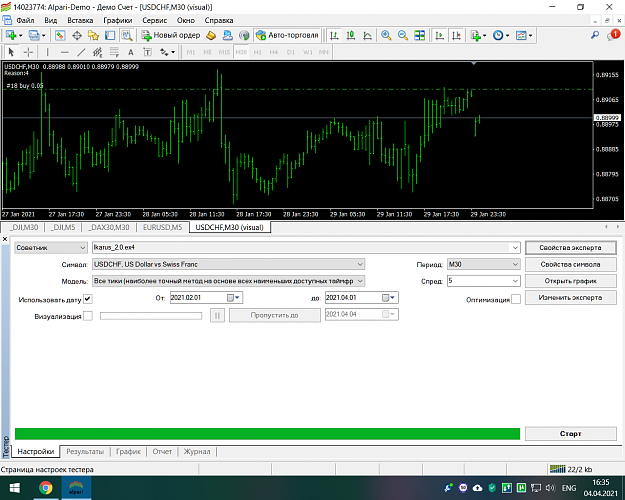

DislikedI've been adjusting a few things with the EA to fall in line with one of my own similar strategies, the results looks promising. However I need to work on reducing the drawdown and protect the balance if a drawdown occurs, since it's a bit high for my personal taste. These test were made with live data between 01/01/2021 - 01/04/2021. ROI: 234 % - Profit Factor: 26.91 - Drawdown: 40.78 % {image} In the second test I tried to reduce the drawdown (same risk used as in the above test and as in MaPi's original settings), however it impacted the ROI...Ignored

3