Disliked{quote} well as you might remember, we have been interchanging messages on blessing. now I have been trading with blessing for a while, with good results, but i trade high timeframes and i try to capture 20-25 per trade. considering that on the 10 pairs, i trade, that means max 6 cycles per week. I will not get rich in a month but i should be able to compound till a point to reach a passive income keeping the down side controlled around 10-55%, per pair. yes it is a lot but I doubt that with blessing, in full auto, it is possible to get any better....Ignored

Hi Fabio

Yes, I recall our discussions on Blessing3.

But, I have to make it clear that in this Trading Made Simple thread, I do not use Blessing3 to trade in its original full auto-mode. I traded with Blessing3 for more than 10 years and I have been active in the jtatoday forum for that long number of years and get to know the development team well and they have helped me a lot.

When I mentioned Blessing3 in this forum, some members jumped to conclusion that I trade Blessing3 as a auto-trading robot. These members were all wrong.

I use the trade management features of Blessing3 as my trade manager.

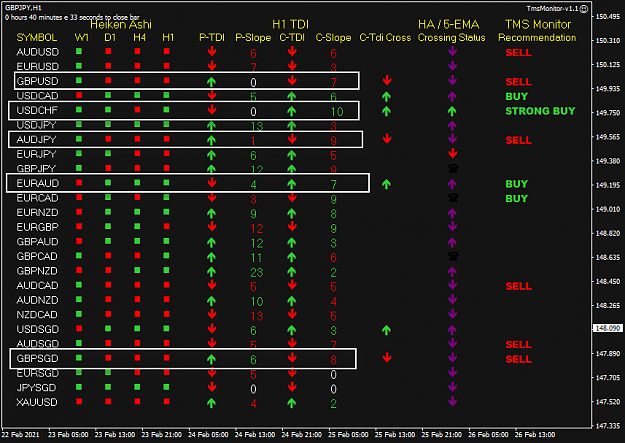

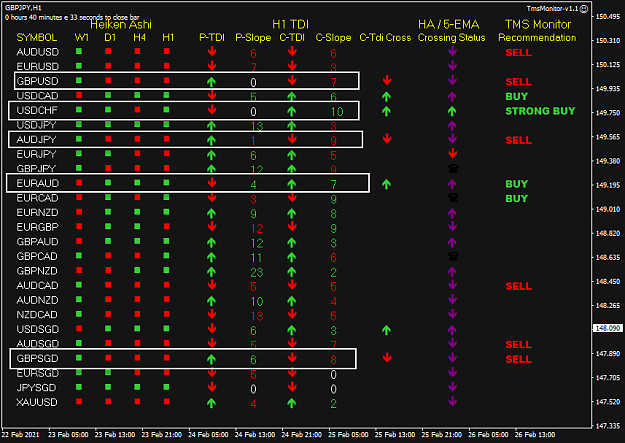

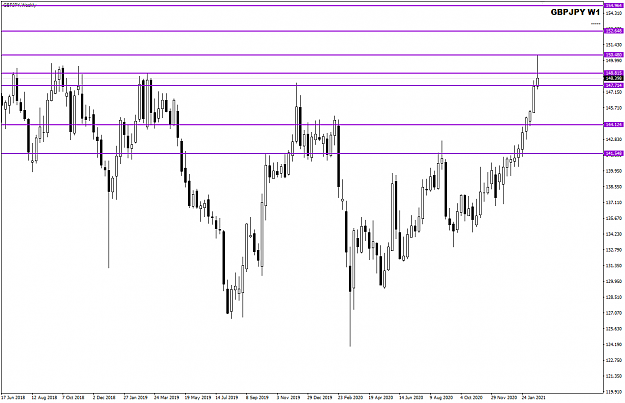

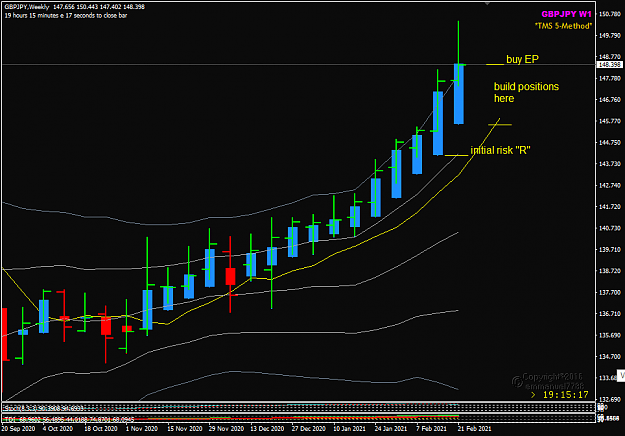

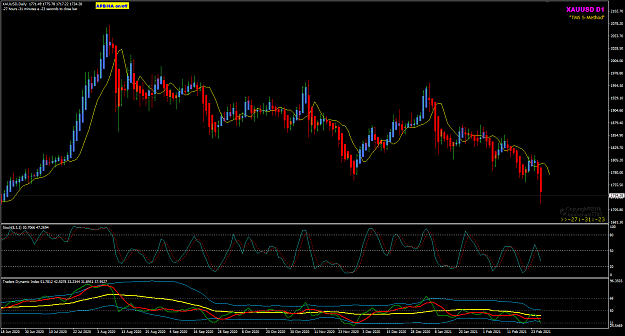

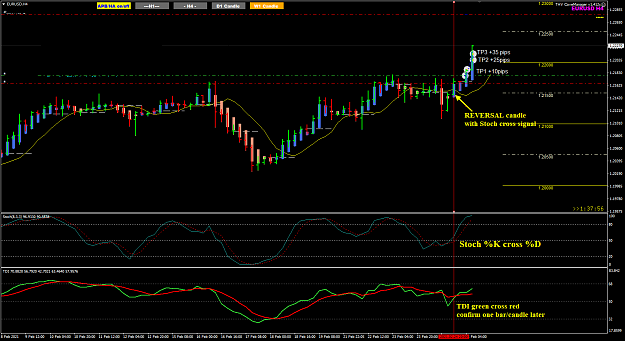

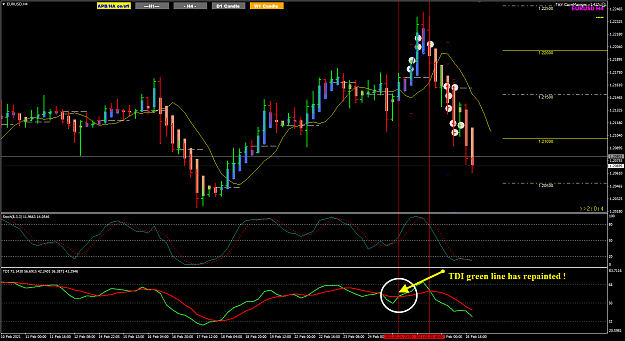

Reason I for this is when the OP Big E mentioned that he was going to test trading the Daily chart, he said to use the TDI green cross red for entry and to exit when the green crosses the red again in the opposite direction. His Post #8703. Based on this and also his trades on Weekly chart, I develop a swing trading strategy using Daily and Weekly and incorporated the Blessing3 trade management into my system.

This is not full auto-trading robot, only the trade management after I initiate the trade direction and the first trade basket using Blessing FMC setting.

I will share more details later when there is more interest in swing trading with TMS 5-Method.

Meantime we can still trade TMS 5-Method H4 and H1.

Trade Well and Trade Safe.

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett

2

2