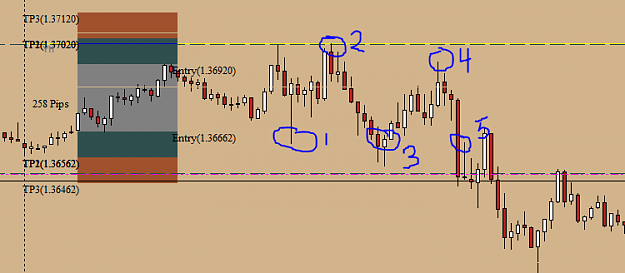

Disliked{quote} Hi Billy For days like this (Jan 12th) where high low is triggered 6 times leading to 5 counters of -26 pips x 5 =-130, would you have stopped after 3 counters? I remember reading somewhere your limit is 3 counters. If so, are the below steps correct? Trade 1 = Long Trade 2 = Short, Short Trade 3 = Long, Long Trade 4 = Short This would result in 3 counters locked at limbo -78 pips. Pardon me if I got it wrong.Ignored

Hi C, and welcome.

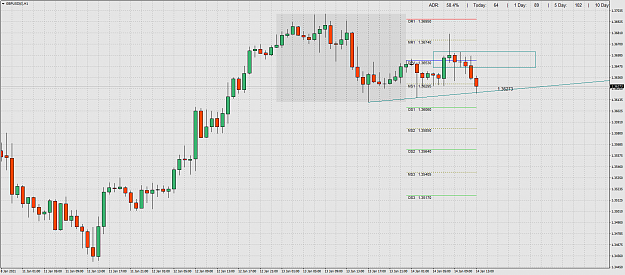

today , Cable 08-00 low broke and made +5 %.

Cable 00-00 4 hour range, high broke and still in motion.

you are correct, in the past i would of made a counter up to 3 times, but times are changing i will counter more, BUT you will find i then trade a different trigger.

originally it was 08-00 fail, trade the 00-00 range for instance.

What ever we do, we must watch the daily range.

Trade well.

SEE LINE,TRADE LINE..PRICE HAS TO GO SOMEWHERE,,, PRICE WILL GO SOMEWHERE.