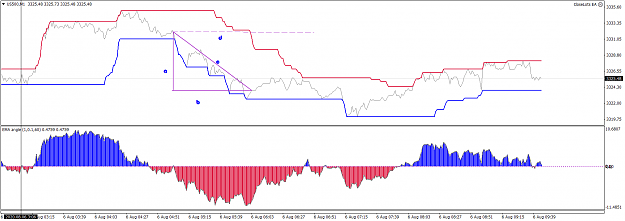

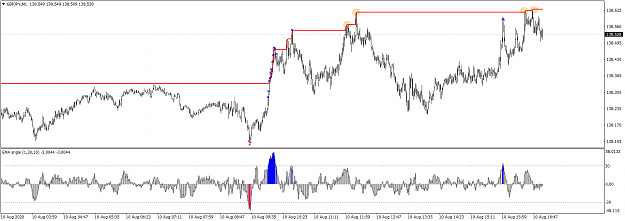

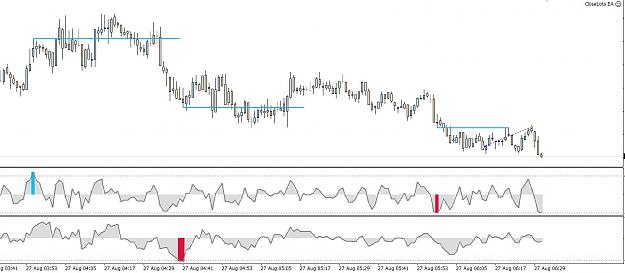

Once you release yourselves from the magical ideas of support and resistance, none of this algo nonsense matters.

This is just price discovery, there is nothing special to it, and you can definitely capitalize on it. So if you know what to look for, use it to your favor.

This is just price discovery, there is nothing special to it, and you can definitely capitalize on it. So if you know what to look for, use it to your favor.

3