MrAnta997,

We are in complete agreement on the purpose of the roadmap and making it our own way of trading.

To that point

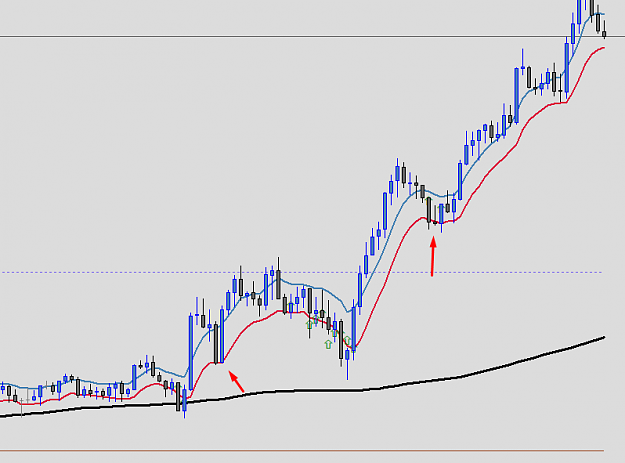

I have two setups that I trade which use the roadmap for the framing of the trade, but the technique is purely mine (actually probably a combination of things I have learned somewhere from others!)

An example is the only trade I saw setup to my liking this morning on GBPUSD.

My favorite PUSHBASE setup...just below the Previous Days Low acting as upward resistance.

Yielded 38pips.

Great to be back able to trade for a couple hours or so everyone morning before work again.

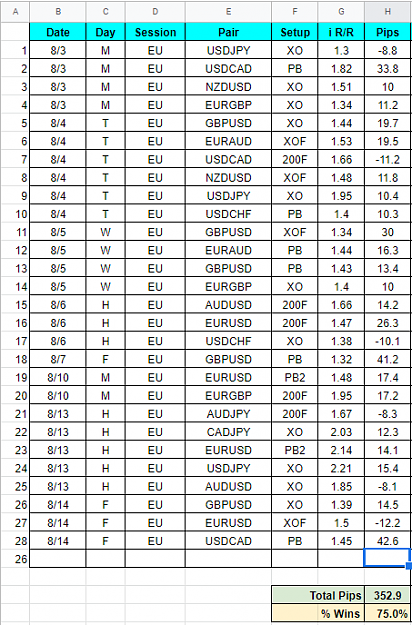

Managed 18 trades, 14 winners and 236 pips net this week trading only 8 pairs on 5 min charts.

I never had this type of performance over such a long period until I found Laura's roadmap.

A great weekend to all and happy profits next week.

We are in complete agreement on the purpose of the roadmap and making it our own way of trading.

To that point

I have two setups that I trade which use the roadmap for the framing of the trade, but the technique is purely mine (actually probably a combination of things I have learned somewhere from others!)

An example is the only trade I saw setup to my liking this morning on GBPUSD.

My favorite PUSHBASE setup...just below the Previous Days Low acting as upward resistance.

Yielded 38pips.

Great to be back able to trade for a couple hours or so everyone morning before work again.

Managed 18 trades, 14 winners and 236 pips net this week trading only 8 pairs on 5 min charts.

I never had this type of performance over such a long period until I found Laura's roadmap.

A great weekend to all and happy profits next week.

9