Anything above the line is an uptrend, below the line is a downtrend.

Software tools for LauraT's Roadmap 167 replies

Forex Brokerage Roadmap 4 replies

Best way to read all of someone's posts? 3 replies

Simple way to read chart 11 replies

DislikedFew trades from today, EA was a total disaster. AUD pairs in general lost strength until NY session. Anyway 3rd day with profit and around 300+ pips profit. And with not much effort. LauraT have I thanked you before? I think I did and I thank you once more. My whole trading view got a new perspective. Thank you. {image} {image} {image} {image} {image} {image} {image}Ignored

Disliked{quote} It's very satisfying seeing the success people have with the methodology. Thank you for sharing, really happy for youIgnored

Disliked{quote} I have to agree with above. Thank you so much. And I am thanking from bottom of my heart. :-) I am over 250 pips profit using this method this week. Also for the trades where I didn't use this... the method still served as a confirmation for entry and exit in the trade. For me more important is that extra confirmation that gives me confidence that I have high probability of winning with that trade. This method changed the way I traded this week. It has given me whole new perspective. Thanks for everything you did here!!!Ignored

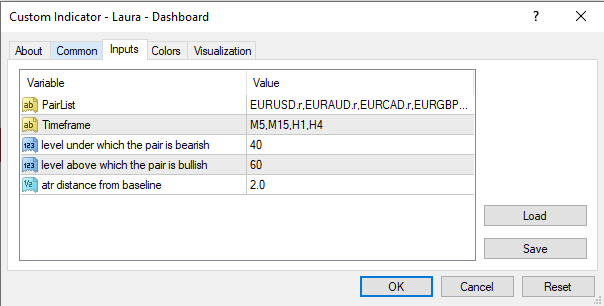

DislikedI know Hanover posted a dashboard, but since I had been working on my own DB during this whole time, I’d thought I’d share it here, it differs only slightly. The indicator must be placed in the indicator folder (Mql4/Indicators) as per usual. When placed on a chart, the settings are: {image} You need to edit the “Pairlist” that you want to appear, and the way it’s displayed on you market watch. Depending on brokers, you can have “EURUSD”, or “EURUSD.”, or “EURUSD.r” for example. Timeframe: Pretty straightforward. I use only 4 TFs, as it can be quite...Ignored

DislikedFinished the day by closing out 2 of my medium term trades on the Dow. {image} And now it starts all over again tomorrow - goodnightIgnored

DislikedHi LauraT, I noticed that the values for the CompRSISelectv2 is slightly different from the TrendStrenght-RSI-MTF. If using the CompRSISelectv2 do we still use above 50 for bullish and below 50 for bearish or do we need to adjust it slightly?Ignored

Disliked{quote} What approach would you use ( for scalping ) on a one minute Dax or Nasdaq100 chart please Laura?Ignored

DislikedHi Laura, great thread, I'm really thankful that you have shared your methodology with us. A newbie like me got into a swing trade for the first time because the system is so powerful that it makes me rethink whenever I want to panic close after gaining few pips. Thanks a lot for your contribution. Here are my 2 trades from this week. I closed first after 30 pips but 2nd is at 96 pips now. {image}Ignored