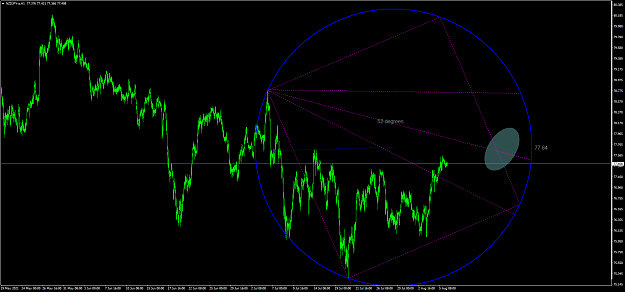

Disliked{quote} I am thinking the 6570 - 6600 +/- area can push kiwi back to 6430-40 levels trigger being FOMC/EU IR rate decision (in absence of any major kiwi data) and mid dec we have kiwi gdp etc which can decide how it moves from there. around 6600 area was significant hurdle when it was moving down too. ofcourse lots of +ve news on kiwi (fiscal stimulus / good cpi / rates on hold/ etc) but question is how much of that is already priced in. also on a longer term basis on weeklies ... kiwi is still on a downtrend.Ignored

1