Looking for profitable short term trades ...|

Poll

- Tool that you use for advantage the most

- Joined Jun 2016 | Status: Sharing EUR/USD Ideas and Insights | 9,296 Posts

Looking for profitable short term trades ...|

- Joined Jun 2016 | Status: Sharing EUR/USD Ideas and Insights | 9,296 Posts

Looking for profitable short term trades ...|

- Joined Jun 2016 | Status: Sharing EUR/USD Ideas and Insights | 9,296 Posts

Looking for profitable short term trades ...|

- Joined Jun 2016 | Status: Sharing EUR/USD Ideas and Insights | 9,296 Posts

Looking for profitable short term trades ...|

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

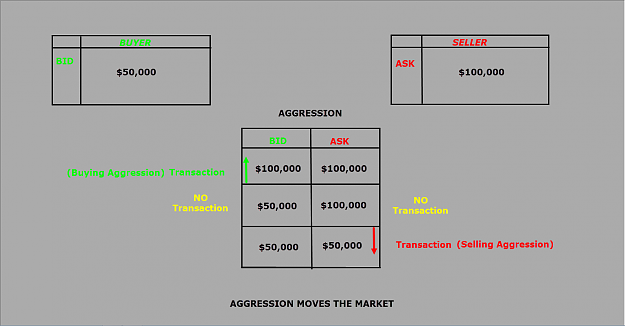

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect