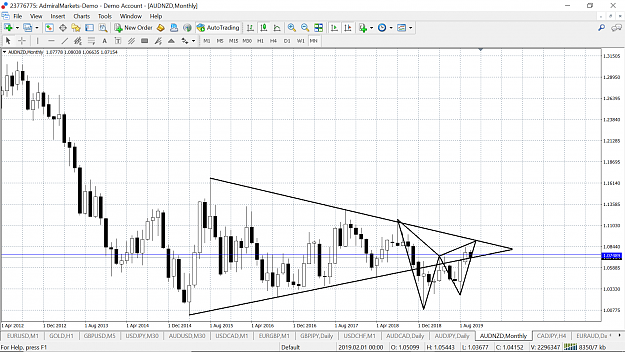

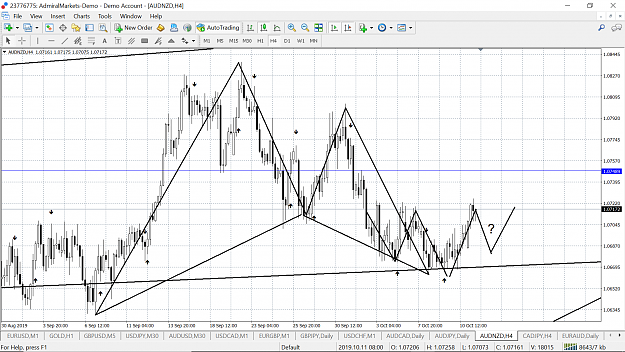

DislikedI have learnt that scenario trading is key to long-term trading success. You anticipate alternative market scenarios and look for a feasible trade setup as the market meets one of the scenarios. What about you?...KPIgnored

DislikedTraders often go into the market with a bias, at least a directional bias. But creating alternative scenarios; e.g. based on ranging, bullish and bearish market mode, is a largely safe-proof approach to the market. Based on the scenarios created, an 'if-then' strategy is developed to deal with whichever scenario the market eventually presents. Trade safe and prosper. KP {quote}Ignored

Each poster is free to use their tools and techniques for reading, analyzing and forecasting the markets but the focus of this thread is on the major pairs (i.e. EURUSD, GBPUSD, USDJPY, AUDUSD, USDCAD, USDCHF and NZDUSD) and the major crosses they form without the USD (i.e. EURGBP, EURJPY, EURAUD, EURNZD, EURCAD, EURCHF, GBPAUD, GBPJPY, GBPCAD, GBPCHF, GBPNZD, AUDJPY, AUDCAD, AUDCHF, AUDNZD, NZDJPY, NZDCAD, NZDCHF, CADJPY, CADCHF, and CHFJPY).

Please do not post on exotic pairs, primarily because of their lack of liquidity and often erratic technical behaviour.

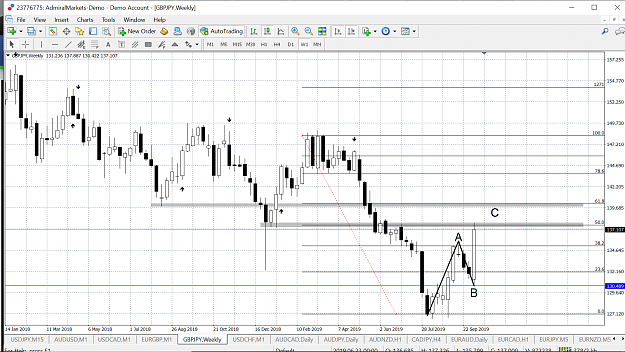

Here's an example of what we should be looking for and doing on this thread.

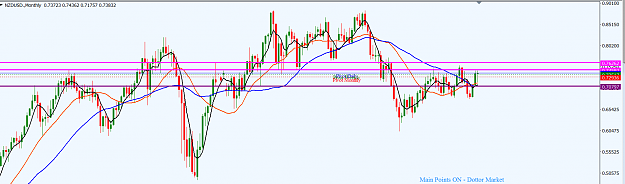

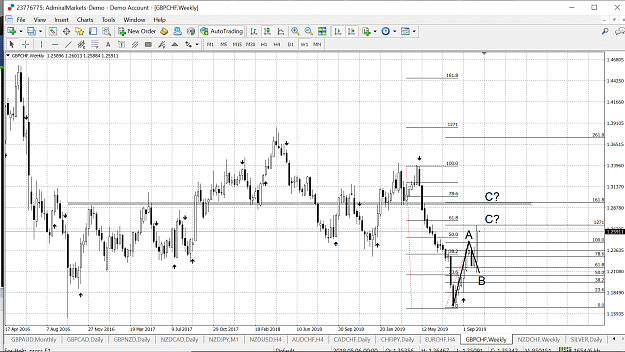

Price action on GBPUSD is currently in a strong reaction zone (1.37390/1.42920) that has held on a multi-year basis (See attached W1 chart). Bulls are likely to struggle to break the zone northward. Should bulls break out of this zone, there is likely to be a strong bullish continuation. But, based on the major trend, which is southward, any upward momentum is likely to be corrective, perhaps to target the 1.46790. Should bears wrestle the initiative and flip the zone, we may see a strong bearish momentum with bears targeting the immediate support zone around the 1.34810 area initially.

Trade safe and prosper.

KP

Disclaimer: This is not a signal service nor a provision of trading advice or trade calls. It is basically to share market analyses withn fellow traders. Each trader should trade based on their own rules and market judgments.

Do your homework, follow the footprints of smart money