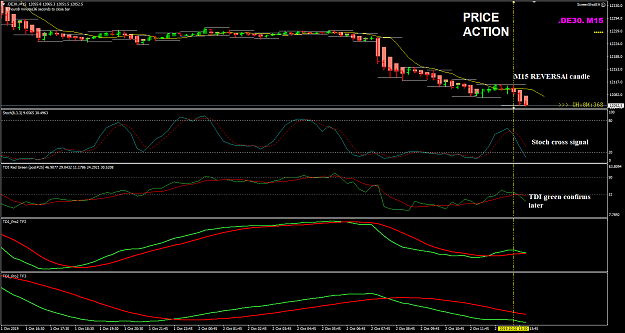

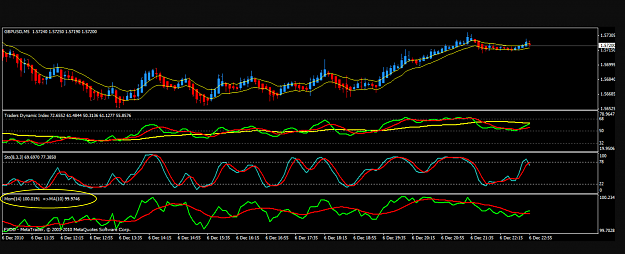

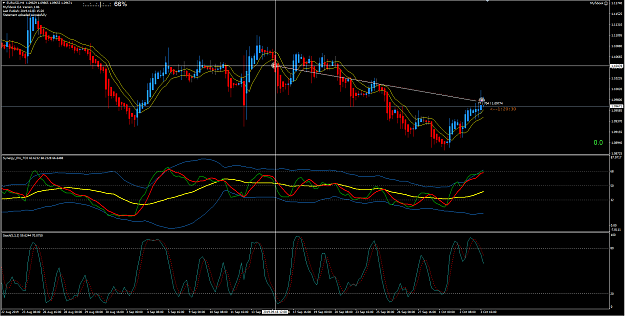

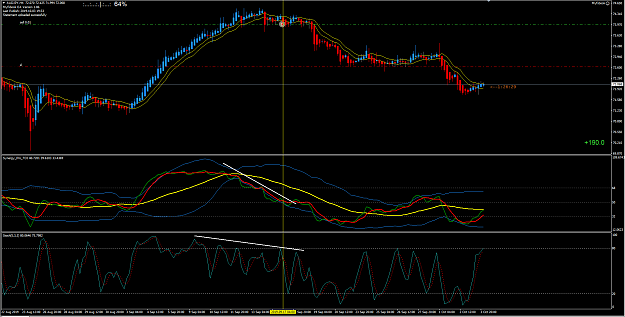

DislikedHi, Can someone please explain to me why this trade went south for my learning? I closed out this demo trade with a loss. Many thanks John {image} {image}Ignored

Hi

With hindsight I can tell you tons of bullshit why it went 'south'

I always remember these:

The 5 Fundamental Truths of Trading by Mark Douglas

1. Anything can happen.

2. You donít need to know what is going to happen next to make money.

3. There is a random distribution between wins and losses for any given set of

variables that define an edge.

4. An edge is nothing more than an indication of a higher probability of one thing

happening over another.

5. Every moment in the market is unique.

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett

2