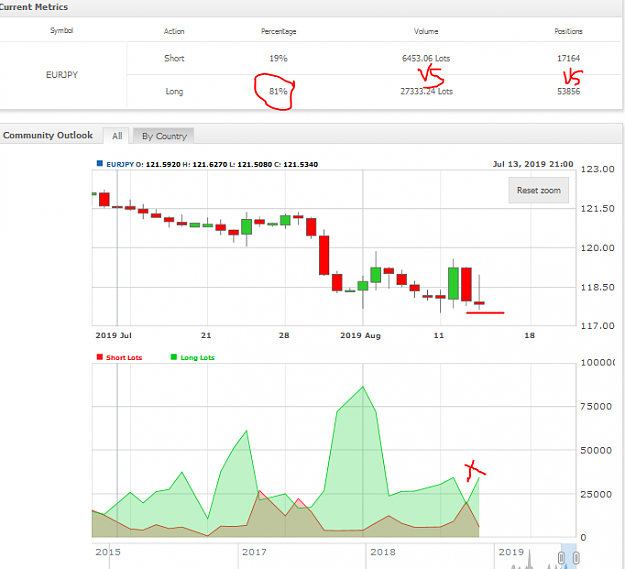

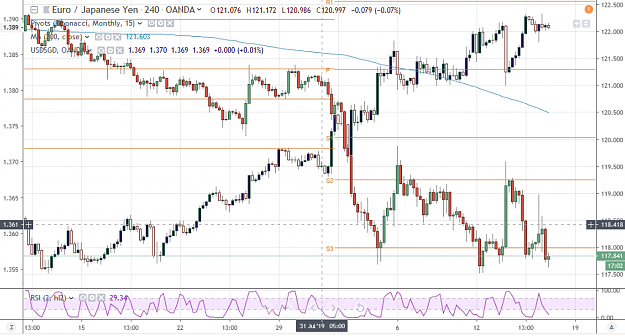

DislikedJust thought to share some vitals from Neils's strategy that can be used in your daily,weekly and monthly analysis to earn decent income. One thing that is constant is the retail positioning from myfxbook and currency strength, every other thing confirms or invalidates this. As I trade kinda of long term I will sight a weekly example. For instance, as at end of last week, we look at our currency strength indicator (which ever one you use) and determine weak vs strong as shown below; {image} As you can see above, the week ended on a risk off mode...Ignored

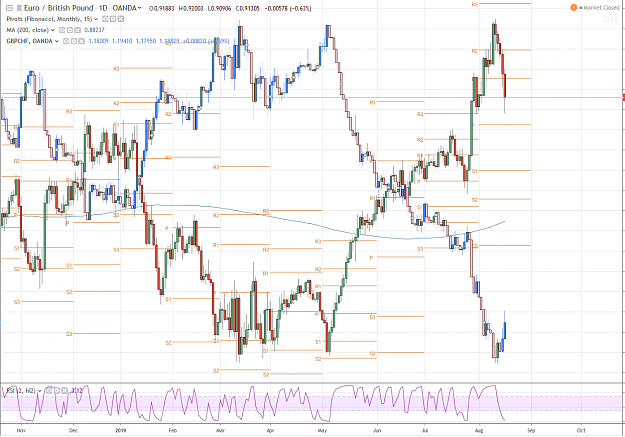

Be fearful when others are greedy