Good morning,

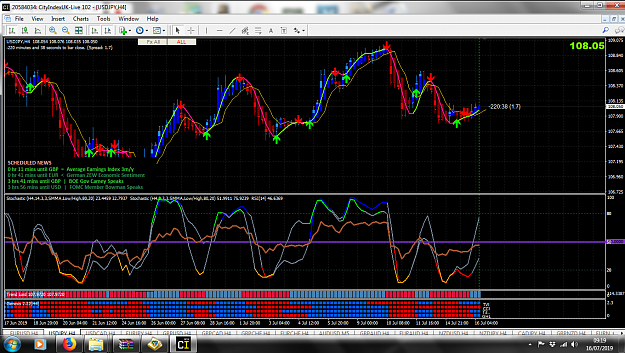

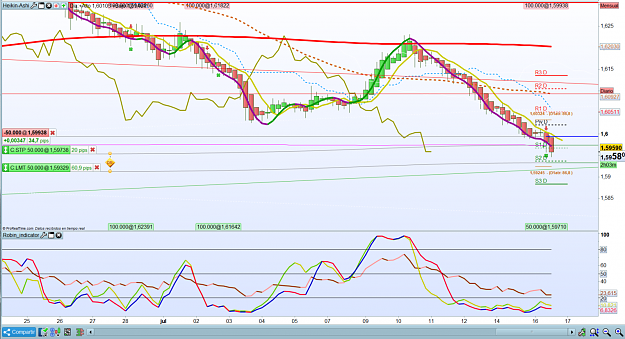

Didn't get a chance to look at the charts yesterday at all and can't see too much of interest this morning. The only 4hr pair that could look good is USD/JPY but at the moment the daily doesn't confirm.

Over the weekend I had a look to see if the Genesis indicator I have at the bottom of my chart could be used instead of looking at the daily. Now this was no detailed analysis, rather a casual glance at a few currency pairs over the past week or so. I have to say that from what I could see, the Genesis indicator worked out well as a filter (all blue or all red) for a trade to be valid. Has anyone else here found that?

Any way, here is the chart

Didn't get a chance to look at the charts yesterday at all and can't see too much of interest this morning. The only 4hr pair that could look good is USD/JPY but at the moment the daily doesn't confirm.

Over the weekend I had a look to see if the Genesis indicator I have at the bottom of my chart could be used instead of looking at the daily. Now this was no detailed analysis, rather a casual glance at a few currency pairs over the past week or so. I have to say that from what I could see, the Genesis indicator worked out well as a filter (all blue or all red) for a trade to be valid. Has anyone else here found that?

Any way, here is the chart