If people understood that if they apply one or two basic patterns and some basic risk manager is enough to succeed.

Instead of trading without controling the risk.

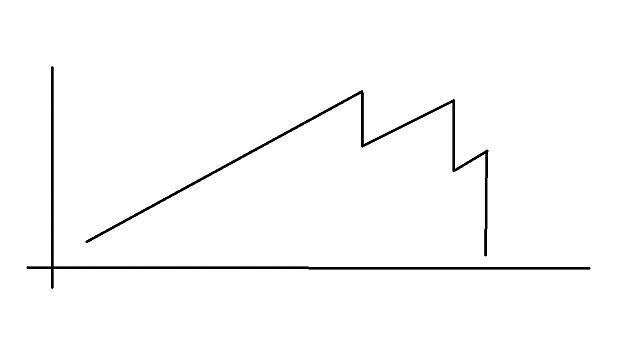

As just an example the simple technique of a channel breakout:

Assuming that we are in a bullish trend and the price is creating a consolidation channel, when the price break the channel in the direction of the trend is the entry and the sl is at the bottom of the channel and we control our risk.

Of course with an experienced trader this technique can be optimized for better results.

Yes, is a very simple and basic technique and there are others that applied correctly is enough to succeed.

This is not a race, it's a marathon.

Instead of trading without controling the risk.

As just an example the simple technique of a channel breakout:

Assuming that we are in a bullish trend and the price is creating a consolidation channel, when the price break the channel in the direction of the trend is the entry and the sl is at the bottom of the channel and we control our risk.

Of course with an experienced trader this technique can be optimized for better results.

Yes, is a very simple and basic technique and there are others that applied correctly is enough to succeed.

This is not a race, it's a marathon.

POW!