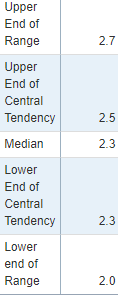

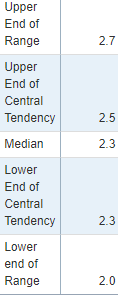

q/q annualized GDP coming

consensus was revised down this week from 2.6% to 2.2%, which is below FED's lower end of central tendency projection for 2019 (but still above their lower end of range though)

consensus was revised down this week from 2.6% to 2.2%, which is below FED's lower end of central tendency projection for 2019 (but still above their lower end of range though)

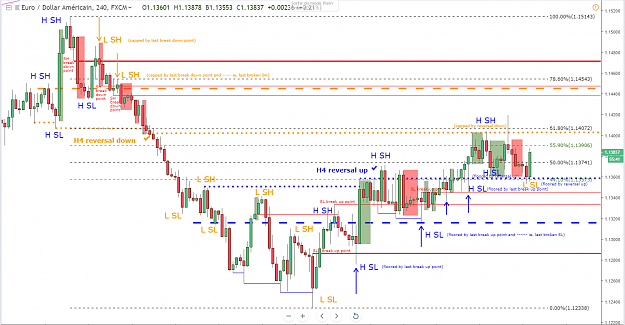

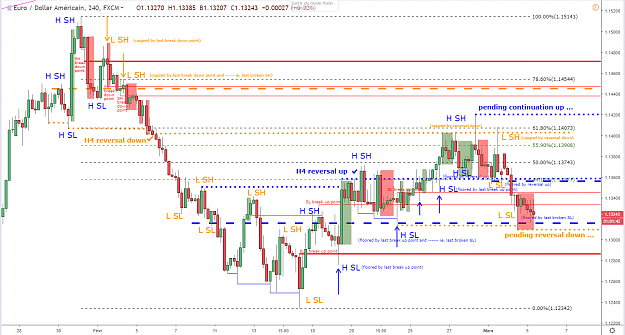

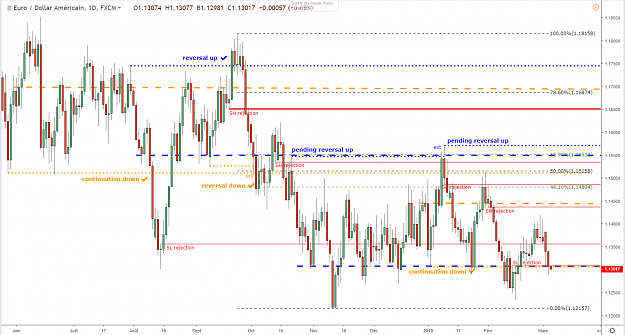

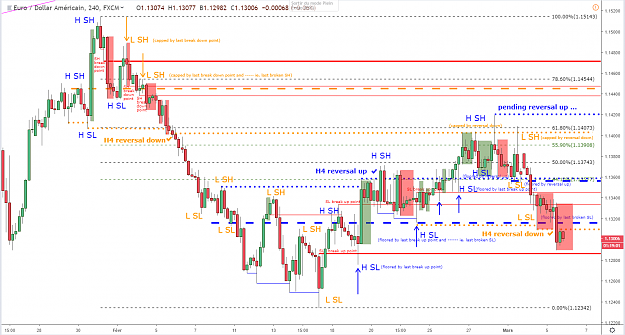

Attached Image