Disliked{quote} i have read page 1 over and over …i was under the impression that we had to wait til the retest of bar 1 to enter long on that example....and sometimes price never retraced to it.....Ignored

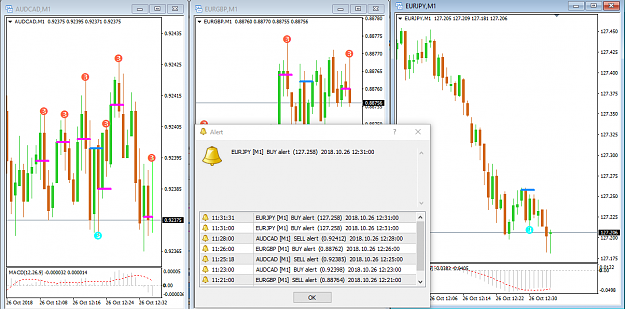

so now you can better understand why there are 2 possible entries.

https://www.forexfactory.com/showthr...5#post11626375

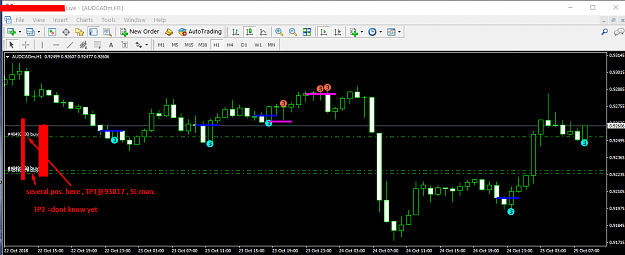

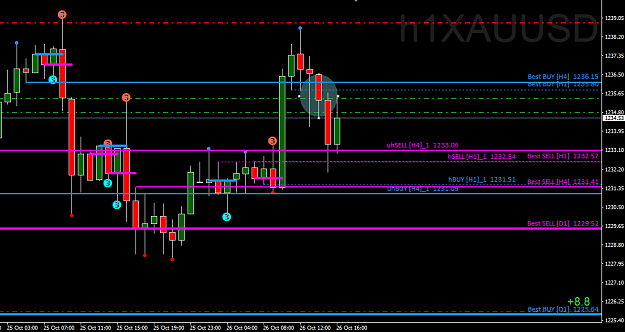

from birdland: "i will buy GN h1 at the close of the candle. and a second position when the price pulls back to the yellow triggerline."

ITB - Seeing Orderliness amongst 'Randomness'

2