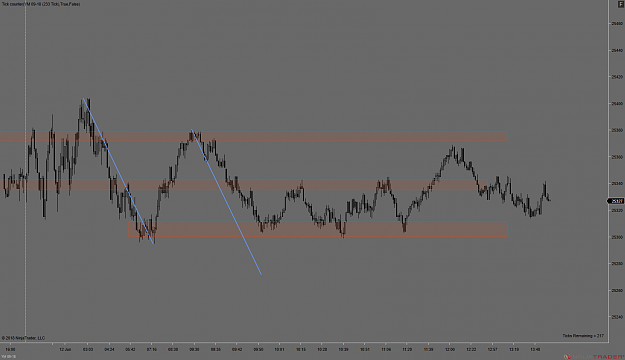

Dislikedbulls have struggled their climb, however the bears haven't shown any signs of entering in just yet (in the last swing). Would this be considered a good time to enter even if i see a rotating candle at my AOI?? The bears made three attempts and have failed to make a NSL. Have the bears weakened?? Let me know your thoughts Damian {image}Ignored

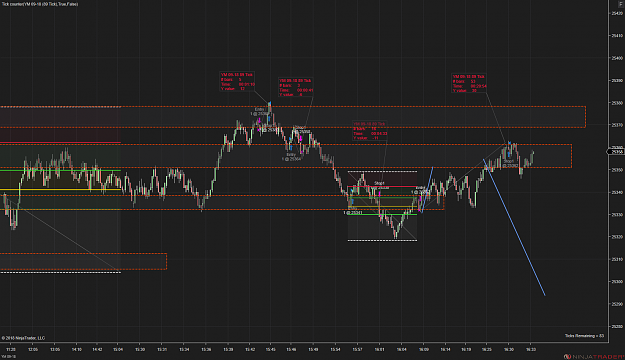

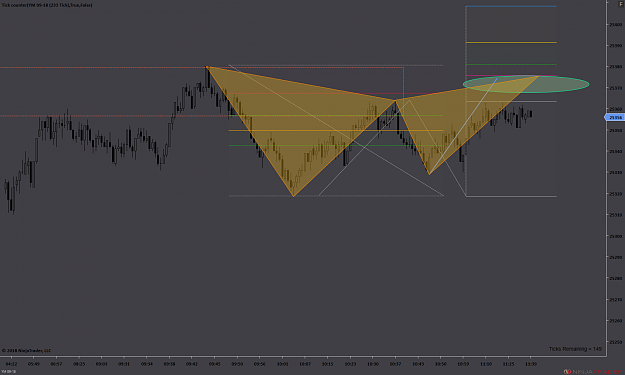

I am sure Damian will correct if I am off base. The current expectation is still a NSL on that order flow, however, the failing to make a NSL multiple times significantly weakens the bears but they are still in control until they break your blue line. Also, looking at the price action it qualifies for being range bound or a complex correction. To enter it would be wise to look for a deep correction where you can take on as little risk as possible. Remember to protect since there is a lot of support and resistance on both sides until it breaks.

Building on those thoughts the AOI should be identified as the structure where the risk is acceptable to the potential reward. Once an engagement zone is identified, if price does what you expect coming to and within that AOI, the trade should be taken. We are not here to filter trades. We trade our plan! With that said, if you don’t like that the market is ranging find something else to do until market conditions are more favorable. Not being in a trade is a position.

~PiProspector

2