Dislikedlisa, how do you handle trades where the TDI signal happens at the same time as the London Open or US Open? do you still take the trade? or do you pass on it?Ignored

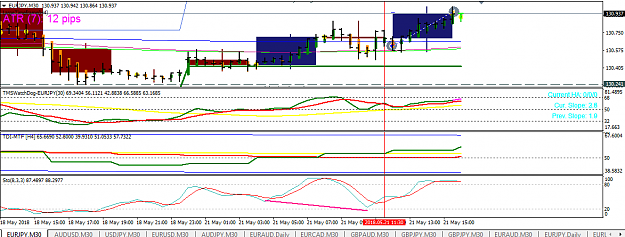

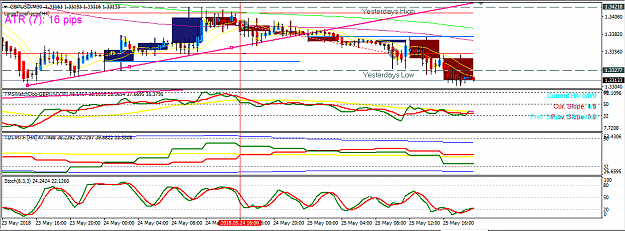

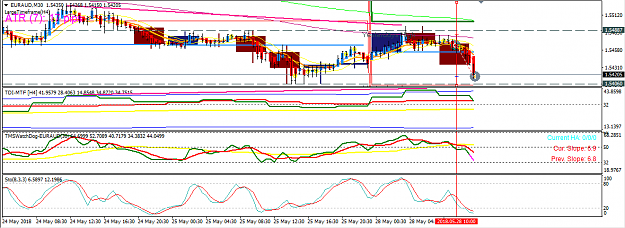

Also could you tell me what risk reward ratio in practise is possible to achieve following this strategy trading the M30 time frame ? Because i noticed in most cases there is no really much room for a potential winner. In most cases i get something around 15-20 pips on average for a winner. Means for a 1:2 risk/reward ratio i would have so set my stop loss around 5 Pips. Also means i would have to hit the perfect timing on each setup not to have it stopped out by every little retracement even if i am correct with the overall trend direction.