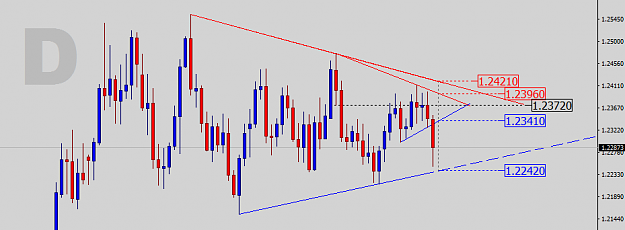

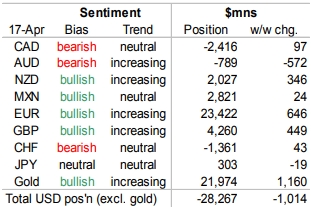

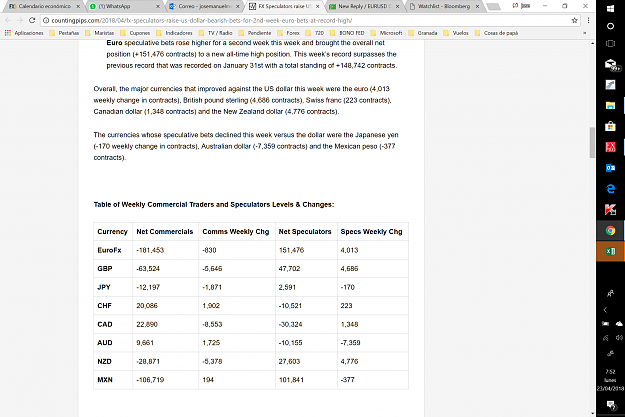

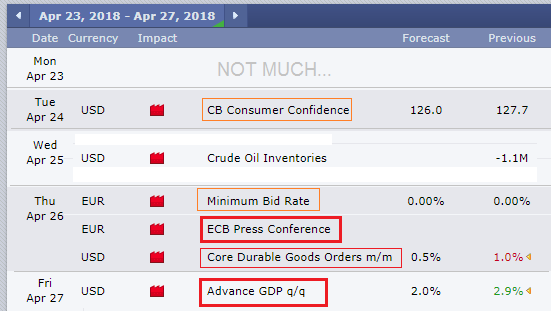

Dislikedthat said most retail traders are not winners in forex business, so we might open a position opposite to their position. -when they start open buy position at top, we should open sell position. -when they start open sell position at bottom, we should open buy position. based on statistics that I observed the change in position of retail traders began to happen when their movement already reached -/+ 10%. see chart below, I apply the theory in eurusd. how do you think? {image}Ignored

thanks