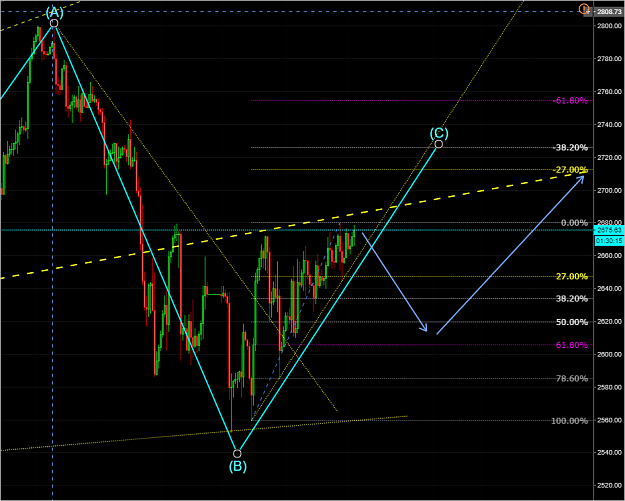

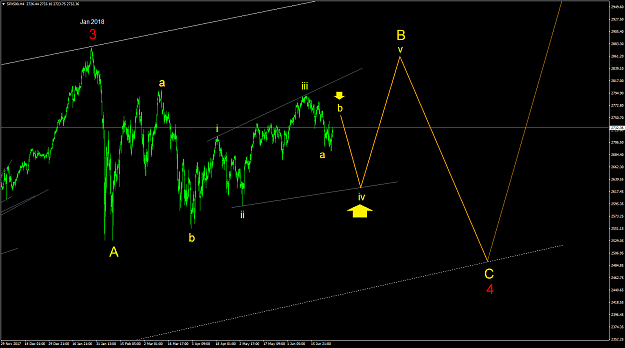

Added more SP short shares on the pull back to 2734.00 This time with SPXU (ProShares UltraPro Shrt S&P 500 ProShrs)

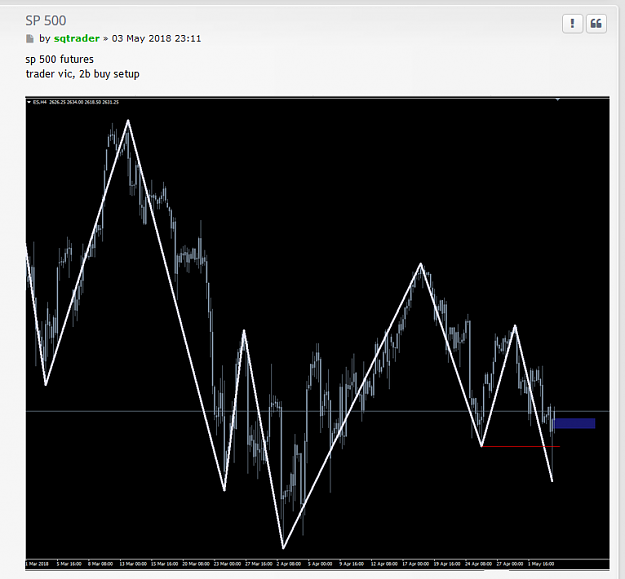

Also banked an SP Nadex put for $26 net per on a $24 buy in on an OTM 2710 strike.

http://content.screencast.com/users/...0Mar.%2001.gif

Also banked an SP Nadex put for $26 net per on a $24 buy in on an OTM 2710 strike.

http://content.screencast.com/users/...0Mar.%2001.gif