Hi guys hope all is well.

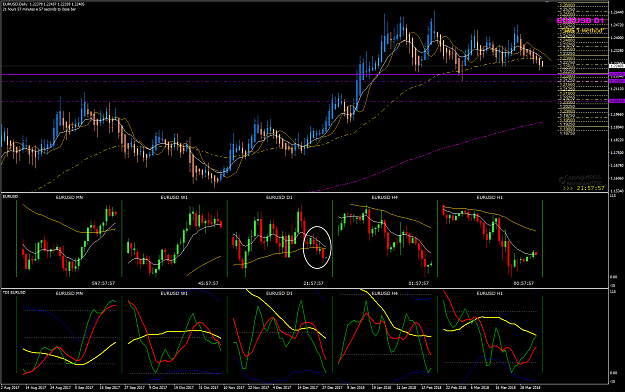

Eurusd i closed out early and lost.

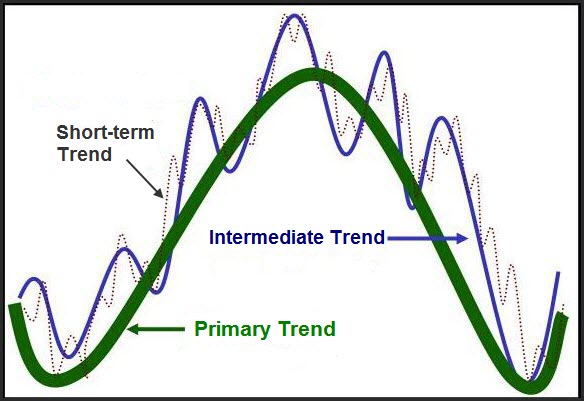

Currently took a trade on usdjyp as a buy, again some movement to the resistance but with the usd being week it could push through, took 2 buys and 2 different profits levels one being at the first ristance 2nd profit at the next resistance.

Any feed back welcome

Cheer

Craig

Eurusd i closed out early and lost.

Currently took a trade on usdjyp as a buy, again some movement to the resistance but with the usd being week it could push through, took 2 buys and 2 different profits levels one being at the first ristance 2nd profit at the next resistance.

Any feed back welcome

Cheer

Craig