Markets are not efficient, rather they are effective - Jones

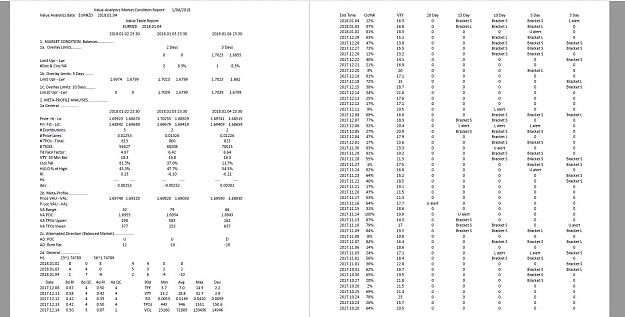

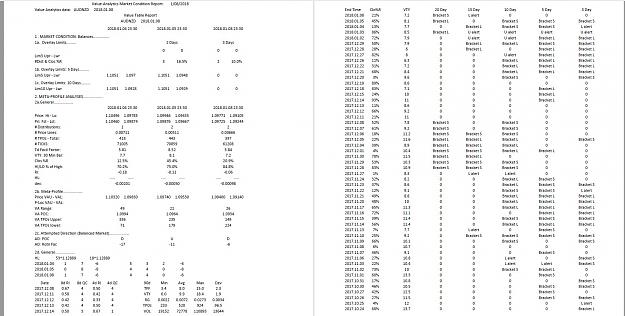

- Post #1,281

- Quote

- Edited 1:37pm Jan 4, 2018 1:26pm | Edited 1:37pm

- Joined May 2009 | Status: Member | 1,879 Posts

- Post #1,282

- Quote

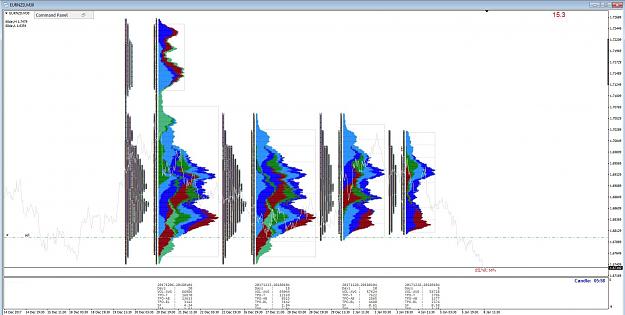

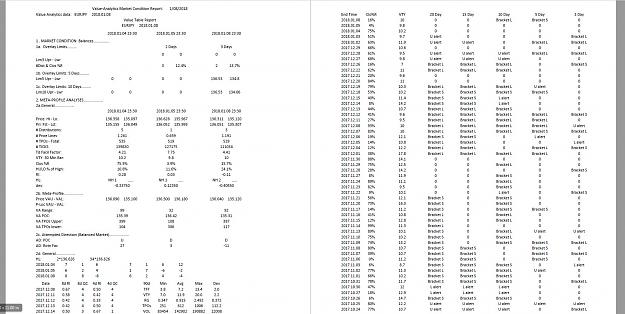

- Jan 5, 2018 12:31am Jan 5, 2018 12:31am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

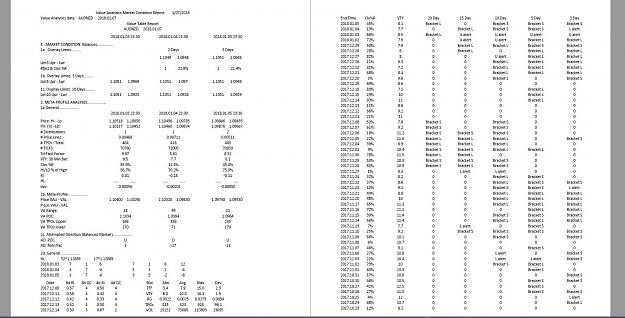

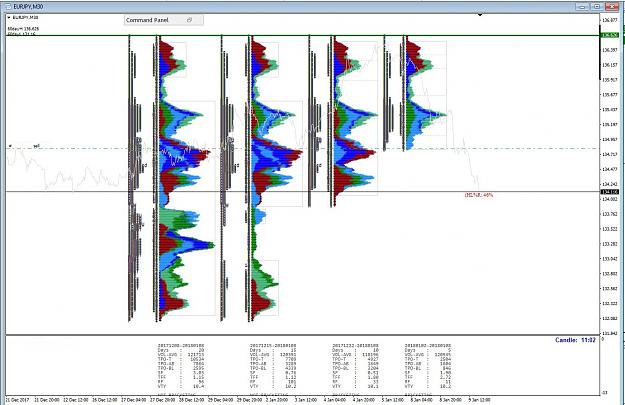

- Post #1,285

- Quote

- Edited 6:17pm Jan 5, 2018 12:28pm | Edited 6:17pm

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

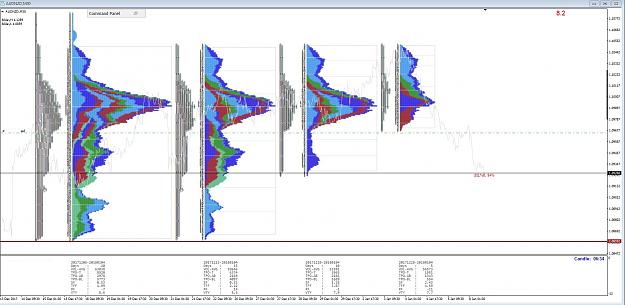

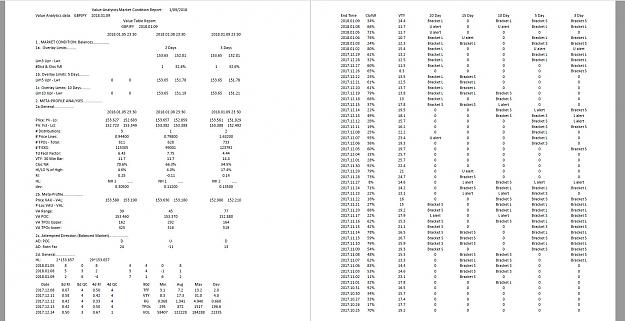

- Post #1,287

- Quote

- Edited Jan 8, 2018 11:04am Jan 7, 2018 11:00pm | Edited Jan 8, 2018 11:04am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,288

- Quote

- Jan 8, 2018 11:03am Jan 8, 2018 11:03am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,289

- Quote

- Jan 9, 2018 3:16am Jan 9, 2018 3:16am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,290

- Quote

- Jan 9, 2018 11:06am Jan 9, 2018 11:06am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,291

- Quote

- Jan 9, 2018 1:43pm Jan 9, 2018 1:43pm

- | Membership Revoked | Joined Sep 2017 | 422 Posts

NO MATTER THE SITUATION,NEVER LET YOUR EMOTIONS OVERPOWER YOUR INTELLIGENCE

- Post #1,292

- Quote

- Edited 4:02pm Jan 9, 2018 3:43pm | Edited 4:02pm

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,293

- Quote

- Jan 10, 2018 10:04am Jan 10, 2018 10:04am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,294

- Quote

- Jan 10, 2018 11:22am Jan 10, 2018 11:22am

- | Joined Jan 2018 | Status: Member | 5 Posts

- Post #1,295

- Quote

- Jan 10, 2018 11:26am Jan 10, 2018 11:26am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,296

- Quote

- Jan 11, 2018 11:41am Jan 11, 2018 11:41am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,297

- Quote

- Edited 4:30pm Jan 11, 2018 3:43pm | Edited 4:30pm

- Joined Feb 2011 | Status: Member | 1,405 Posts

- Post #1,298

- Quote

- Jan 11, 2018 5:04pm Jan 11, 2018 5:04pm

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #1,299

- Quote

- Jan 11, 2018 10:18pm Jan 11, 2018 10:18pm

- Joined Feb 2011 | Status: Member | 1,405 Posts

- Post #1,300

- Quote

- Edited Jan 12, 2018 1:45am Jan 11, 2018 10:29pm | Edited Jan 12, 2018 1:45am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones