Quoting jarrooDislikedSee post 1007.

Use the most current one.

JimIgnored

Anyone still trading Mouteki? 45 replies

Jumper's journal of Mouteki trading 74 replies

Mouteki Trading System 3 replies

Favourable pairs for Mouteki trading... 7 replies

Kalesh's journal of Mouteki Trading 25 replies

Quoting jarrooDislikedSee post 1007.

Use the most current one.

JimIgnored

Quoting smjonesDislikedBingo! Yes you are right. There it is written in the official record. Thanks much, ScottIgnored

Quoting daerusDislikedI just closed out as well, +138 pips.Ignored

Quoting minuteDislikedboth entries look correct, but now we get into the area of should you let the trade reverse on you. Mouteki in one of his powerpoint presentations closed a trade early, I believe since it stalled = thus protect pips gained at the expense of hitting the target. Perhaps some discretion is involved here.

I recommend anyone view that powerpoint for themselves rather than take my word for it, just in case im wrong.Ignored

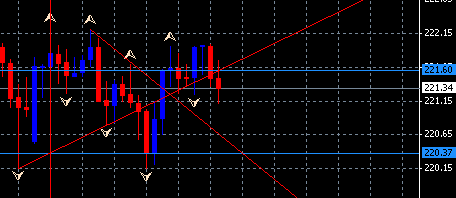

Quoting jumperDislikedHi everyone,

Are there any lessons we can draw from the attached example? I went short first, then got stopped out... then I went long, and got stopped out again. Was I just plain unlucky to hit on a "non-working" trade, or did I mess up somewhere?

Thanks.Ignored

Quoting jumperDislikedHi everyone,

Are there any lessons we can draw from the attached example? I went short first, then got stopped out... then I went long, and got stopped out again. Was I just plain unlucky to hit on a "non-working" trade, or did I mess up somewhere?

Thanks.Ignored

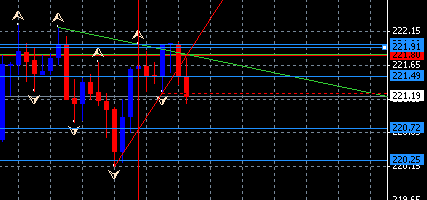

Quoting summitfxDislikedThis currency pair has about a 200 pip range during a 24 hour period. You may want to hash over your tight stop loss orders.Ignored

Quoting summitfxDislikedThis currency pair has about a 200 pip range during a 24 hour period. You may want to hash over your tight stop loss orders.Ignored

Quoting jumperDislikedHello.. I know this is a very wild pair... but are you suggesting I give a wider stop while still trading Mouteki style?

So far, the only modification I have made is to reduce my TP target. Instead of using the projected number of pips, I aim for just two-thirds of it. I don't need to eat the whole pie; I just want some lunch. Currently, I am trading with sound money management (I hope), risking just 1% per trade and only going for trades with at least 1:1 risk:reward ratio. But I get carried away a bit by Mouteki method and some of my trades are more correlated than I normally allow.Ignored

Quoting dangermanDislikedWithout looking at the details i'm not sure if you messed up, but yen crosses can have very large average daily ranges (well over a hundred pips), so your s/l might have to be adjusted accordingly.

In other words, if your projected target was 100 pips, and your s/l was 33 pips per the Mouteki method, that might only be 1/4 or 1/5 of the average range of pips that pair might move on any given day. Working off a 4 hr chart that might not be enough room for the trade to "breathe".

Perhaps Mouteki will post what pairs he finds his system works best on.

Some systems work on some pairs and not others.

JimmyIgnored

Quoting jumperDislikedSo far, I think Mouteki had posted examples on GBP/USD and GBP/JPY. What you and summitfx said makes sense, but I am hesitant to make too many modifications to the original Mouteki method.

When Mouteki has some time to spare, I would greatly appreciate if you would comment on whether we should allow more "breathing space" for certain pairs, or if you would just not trade some pairs altogether. Thanks. ;-)Ignored

Quoting dangermanDislikedYou know, I think Mouteki is sitting back and watching this thread to see how people are learning to trade this system on their own. He jumps in once in a while with some info (almost perfect timing), but it seems like by then most people following the thread have already surmised or intuited what he was going to say. Almost like a college professor who lets the class take over the classroom, at least for a while

Great teaching job Mouteki!Ignored