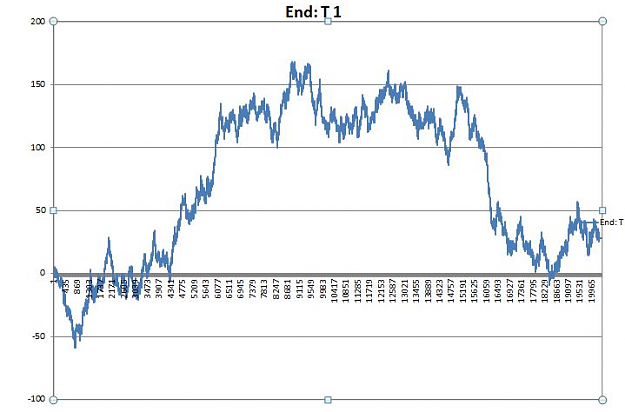

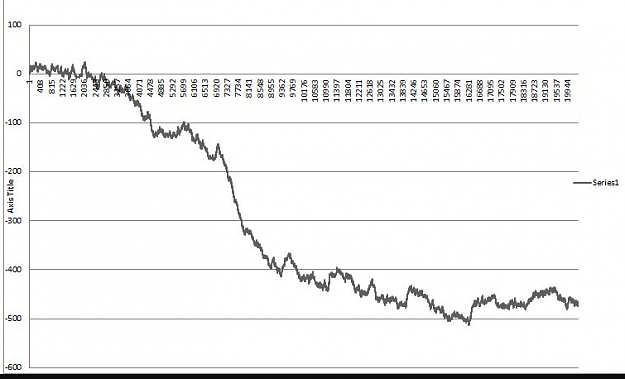

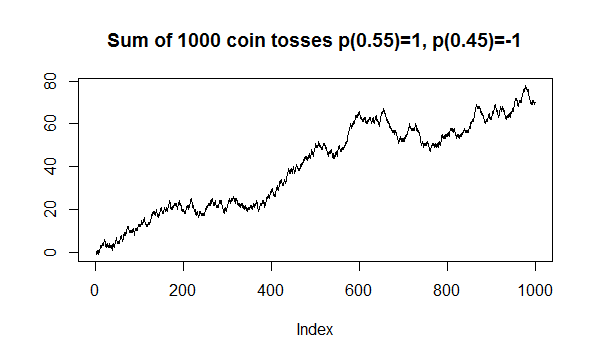

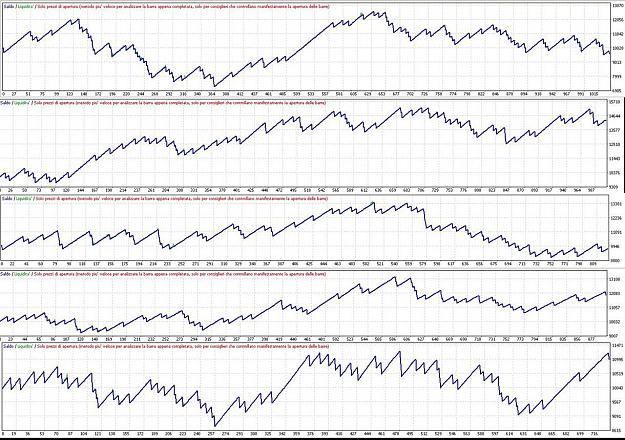

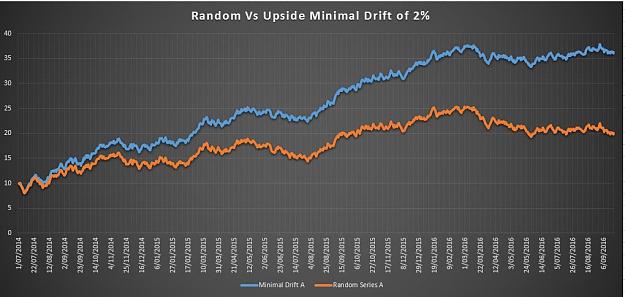

Greetings and salutations to all fellow Forex traders. This thread is called Trend Trading for a simple reason. It is thus, either trends exist in Forex or they don't. If trends don't exist, then currency markets are simply a random walk, with no direction anymore likely than another. If currency moves are completely random, then it would be no more possible to make a consistent profit off trading Forex than making a consistent profit off the toss of a pair of dice or the spin of a roulette wheel. It's ok to believe that, but if you do, you'd may as well go to the casino. At least you get free drinks with your bets there. If however you believe that trends do exist in forex, then this thread will discuss how to find and profit from them. This argument has been going back and forth between finance and math guys for years, and we aren't going to solve it here. Here, we will just assume trends exist and try to reveal how to make a profit from them.

Just a few rules. Anyone of any level of experience is welcome to post here. I only ask that everyone remain respectful and try to keep a positive attitude. I find that the more positive my attitude, the more positive my trading results. I'm hoping experienced traders can discuss items of mutual interest here and along the way they can mentor newbies, not crush their dreams. Just one other thing, we are here to discuss trading. Discussions of other topics should best be left to other threads. That said, trolls will be immediately banned. Otherwise, any questions or comments regarding trading are welcome from anyone. Let's begin.

Just a few rules. Anyone of any level of experience is welcome to post here. I only ask that everyone remain respectful and try to keep a positive attitude. I find that the more positive my attitude, the more positive my trading results. I'm hoping experienced traders can discuss items of mutual interest here and along the way they can mentor newbies, not crush their dreams. Just one other thing, we are here to discuss trading. Discussions of other topics should best be left to other threads. That said, trolls will be immediately banned. Otherwise, any questions or comments regarding trading are welcome from anyone. Let's begin.