Hi,

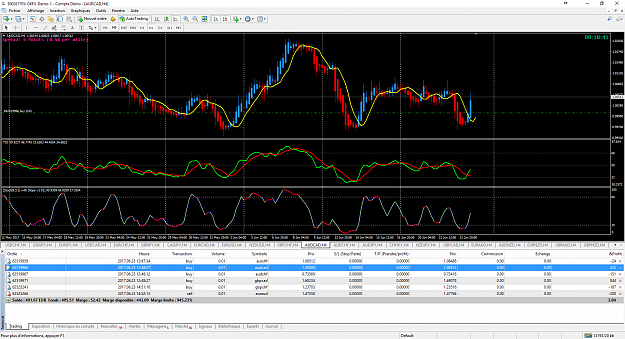

I tried since this night this method on a demo account.

I wille try also on real account.

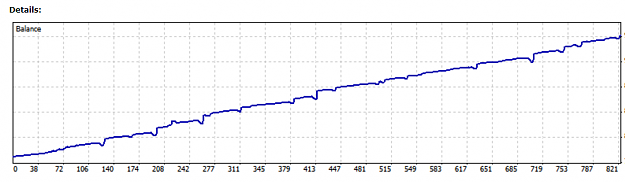

So strange or incredible results

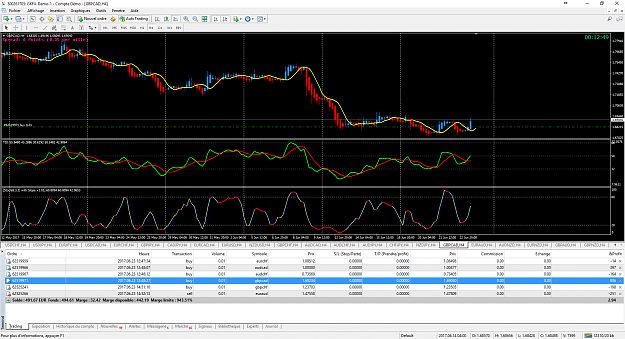

I tried since this night this method on a demo account.

I wille try also on real account.

So strange or incredible results

2