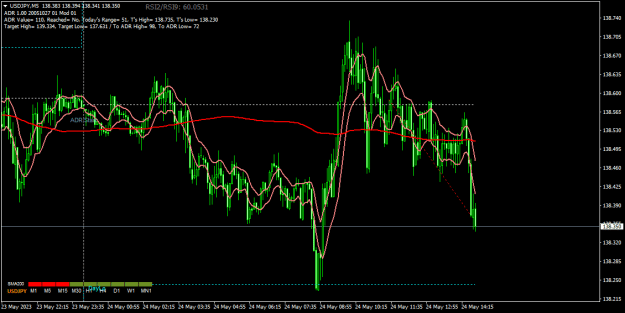

DislikedI think one issue was that I would take trades where even though a bar would close on the "right" side of the 15m channel, the 15m channel was on the opposite/wrong side of the 200sma in relation to the direction I was trading, and price would often bounce off the sma. {image} {image} Another issue was trading when volatility was low. This would cause situations where one bar would close outside of the channel and then one bar would close back inside the channel, and so on. This exercise seems to work better during high volatility. Another observation...Ignored

If you're willing, I'd like you to repeat the exercise but, before doing so, please create a checklist for yourself. Include those elements you have identified and force yourself to do a quick run-through of the checklist before entry. You really aren't far away from where you need to be with these exercises now.

The FOMO and over-trading can be tackled with what I previously mentioned - either 5 trades per day or, if that proves too comfortable for you, 3.

2