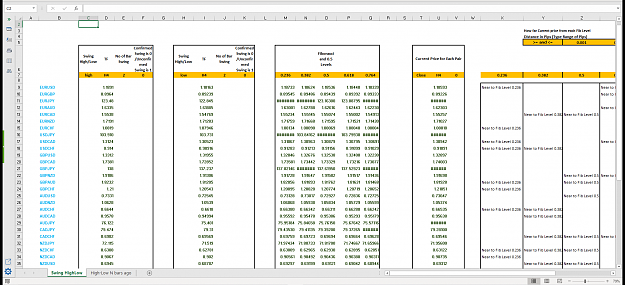

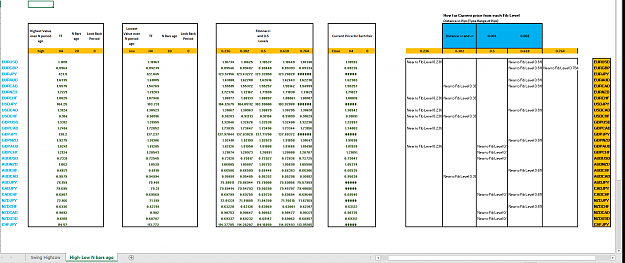

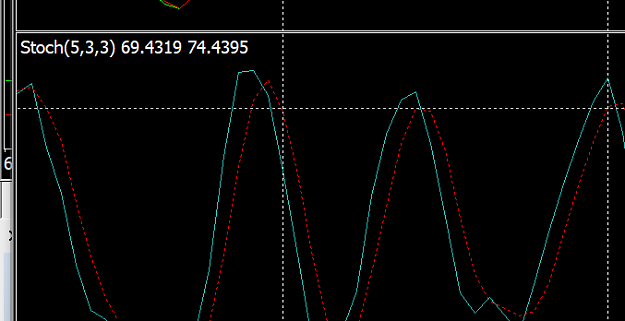

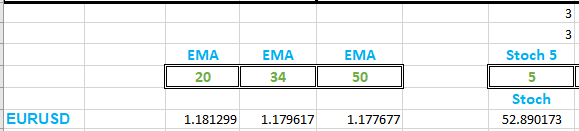

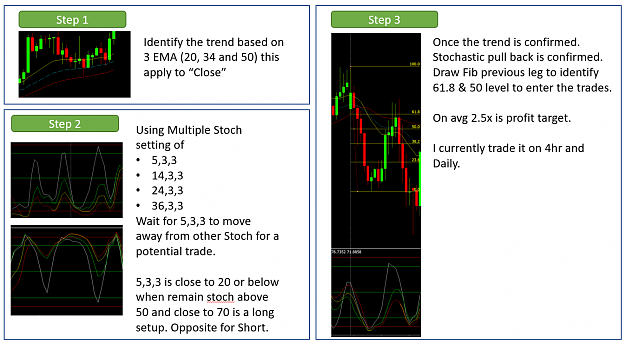

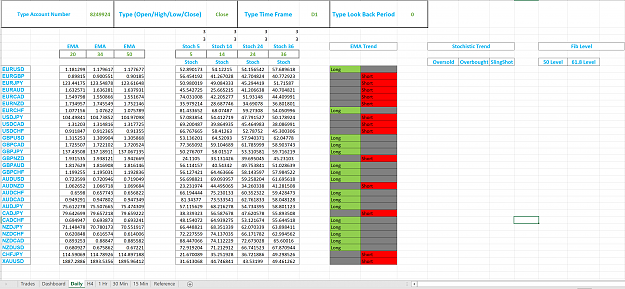

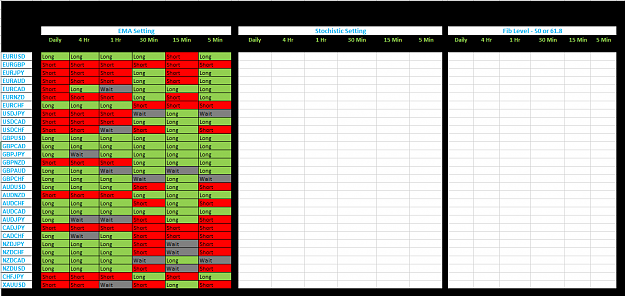

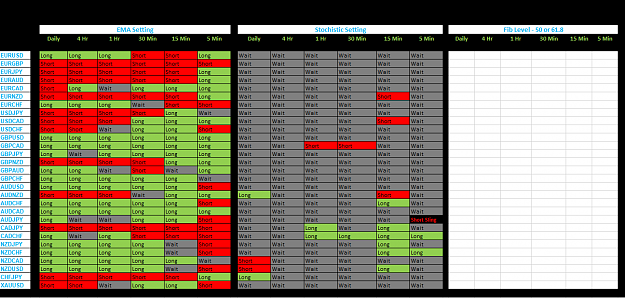

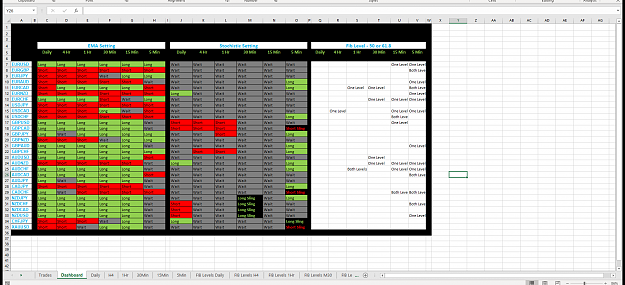

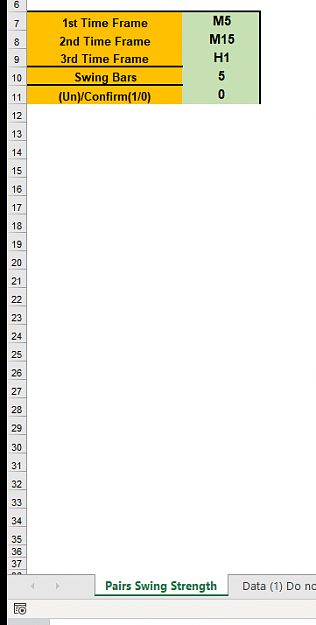

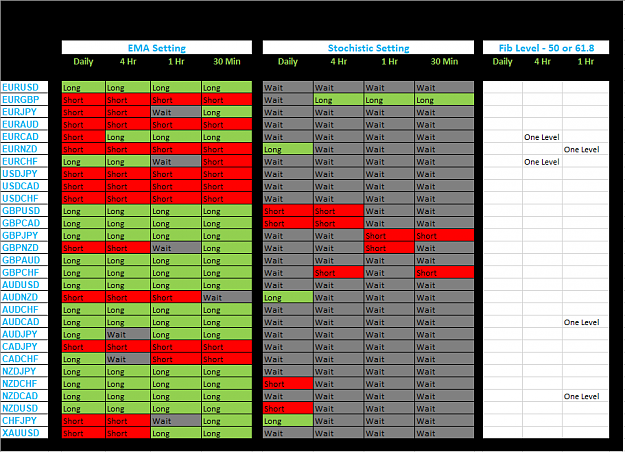

Disliked{quote} I attached the previous indicators template with stochastics added. In case you need a list of other indicators, list them for me. {file}Still working on the Fibonacci levels.Ignored

https://www.forexfactory.com/thread/...55#post8438155

Best of luck and stay green always!

Jibala

PDF & BCC (Patience Discipline Focus & Belief Confidence Consistency)