Hello forex Folks!

I'd like to share with You my system that I was comming to for many years. I am testing it these days and it gives nices results.

I have not enough time in my life to sit at the computer to trade forex (work, kids, house building), so I constructed this system to set and get back to after week or two (checking the results on my phone during a week).

So here are the main ideas:

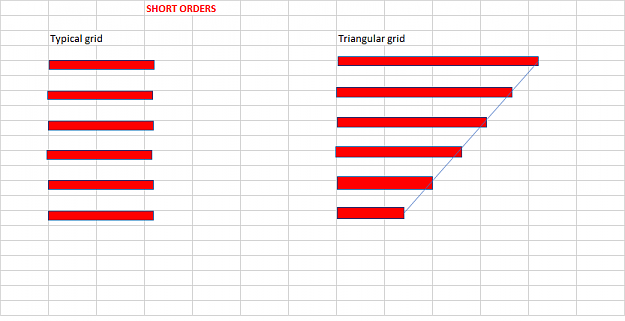

1. It is not a typical grid, but has much in common with grid system.

Instead of putting X equal-size orders, triangle system puts orders of biggest size at best prices, and loweste.g.:

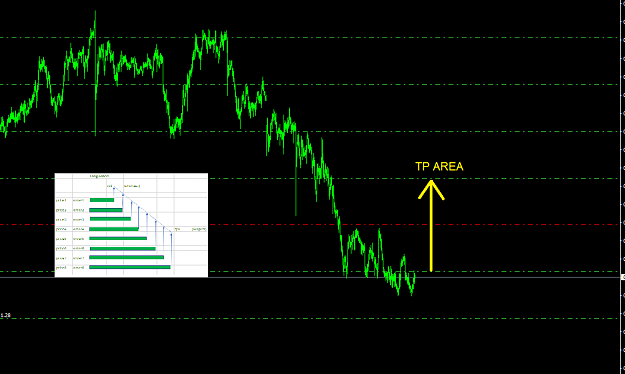

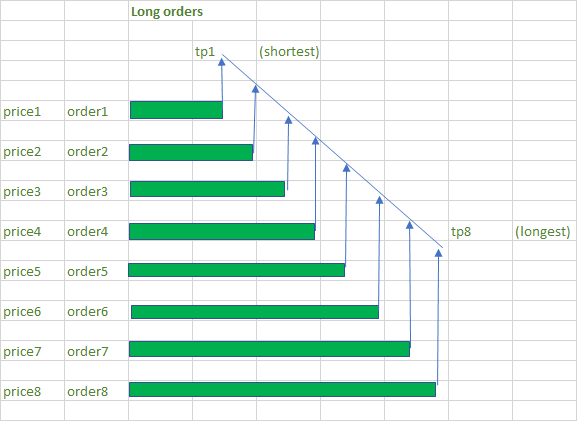

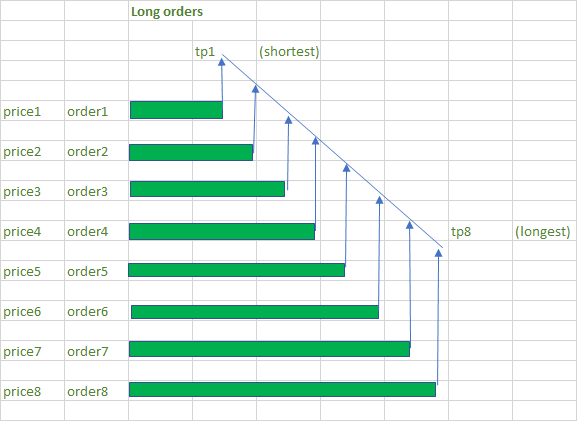

2. In a preliminary version I was putting longest TakeProfits for the best-price orders, and shortest TakeProfits for worst-price orders. eg.:

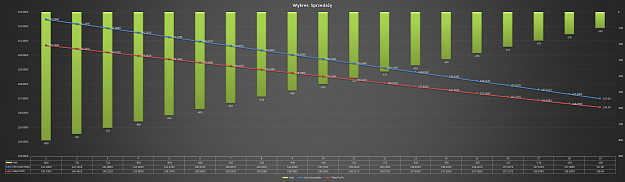

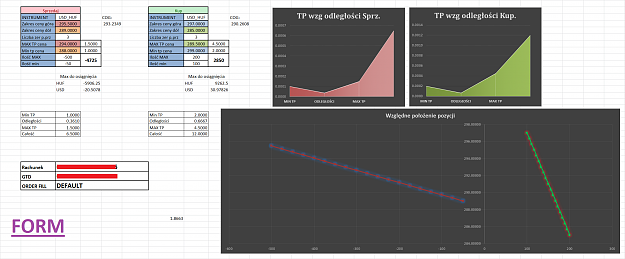

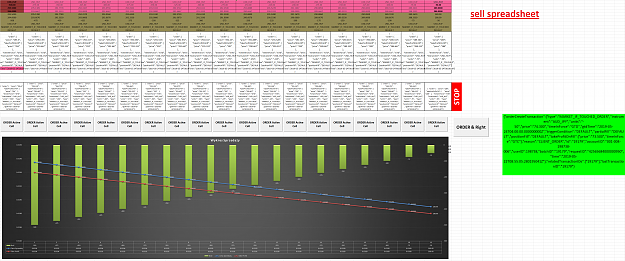

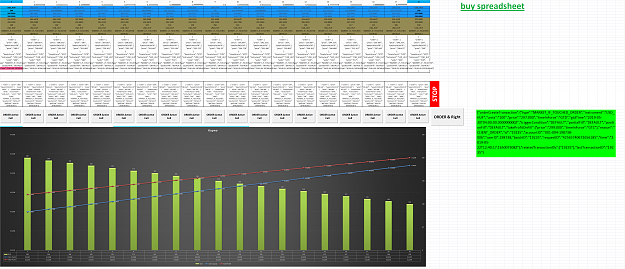

3. To calculate position size and take profits for all of orders in a triangle I set: size and tp for minimum and maximum and then I use excel file to calculate others proportionally.

4. As I am trading small but real only money, I use OANDA accounts, but its just because I can trade flexible sizes of orders ( starting from 1 base currency), and what is more important when I calculate such triangle from e.g. (100$ - 1000$) then around twenty orders between them have values like 150$, 650 $ etc. so these are not standard mt4 trade sizes

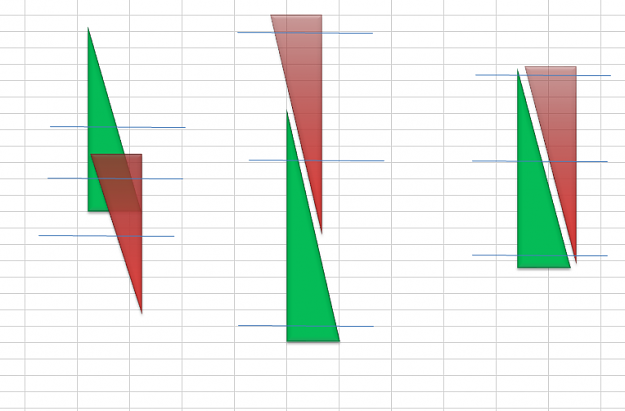

5. I most often trade this both directions, adjusting size and relative positions of triangles to expected situation on a pair:

I'll continue in next post. If somebody has some question so far, please ask.

Like I say, it is system I am still working on, but I have already some experience with.

I prefer discussing only about this system in this thread.

Best Regards

Marecki

I'd like to share with You my system that I was comming to for many years. I am testing it these days and it gives nices results.

I have not enough time in my life to sit at the computer to trade forex (work, kids, house building), so I constructed this system to set and get back to after week or two (checking the results on my phone during a week).

So here are the main ideas:

1. It is not a typical grid, but has much in common with grid system.

Instead of putting X equal-size orders, triangle system puts orders of biggest size at best prices, and loweste.g.:

2. In a preliminary version I was putting longest TakeProfits for the best-price orders, and shortest TakeProfits for worst-price orders. eg.:

Attached Image

3. To calculate position size and take profits for all of orders in a triangle I set: size and tp for minimum and maximum and then I use excel file to calculate others proportionally.

4. As I am trading small but real only money, I use OANDA accounts, but its just because I can trade flexible sizes of orders ( starting from 1 base currency), and what is more important when I calculate such triangle from e.g. (100$ - 1000$) then around twenty orders between them have values like 150$, 650 $ etc. so these are not standard mt4 trade sizes

5. I most often trade this both directions, adjusting size and relative positions of triangles to expected situation on a pair:

I'll continue in next post. If somebody has some question so far, please ask.

Like I say, it is system I am still working on, but I have already some experience with.

I prefer discussing only about this system in this thread.

Best Regards

Marecki