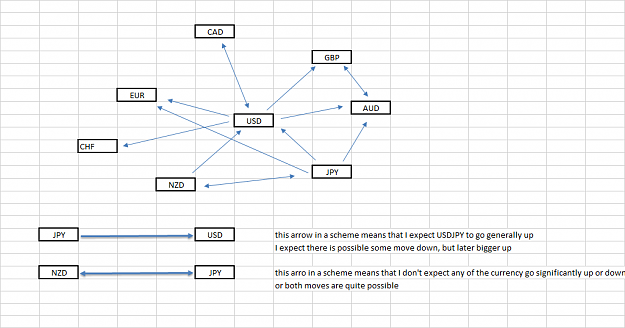

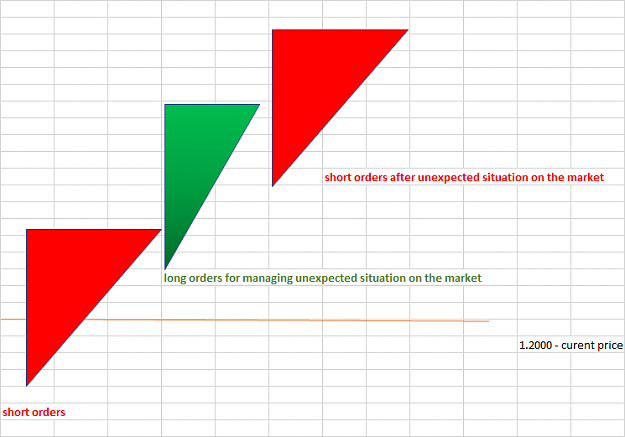

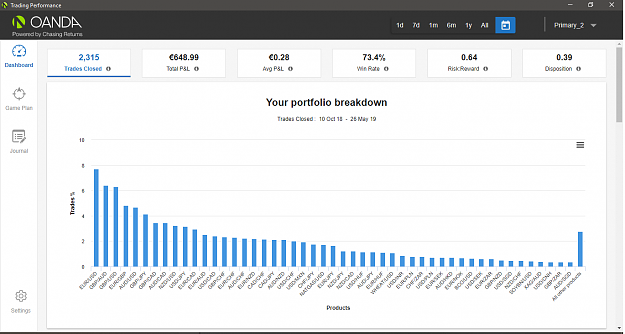

DislikedBefore continuing let me welcome You in this thread! sam 68: thank You for Your interest, I hope You'll enjoy it! kaixinjili: Yes I did, I am now testing it in more advance scope. I think there will be time to start simple and make it more advanced after. zotium: Actually You're not that wrong. In this strategy we will be trading few pairs at the same time, sometimes hedging like in Your example. LDFX: This thread is not to argue or to prove something to anybody. Let's keep this thread as a place for constructive discussion. Like I said on the beginning,...Ignored

Well,

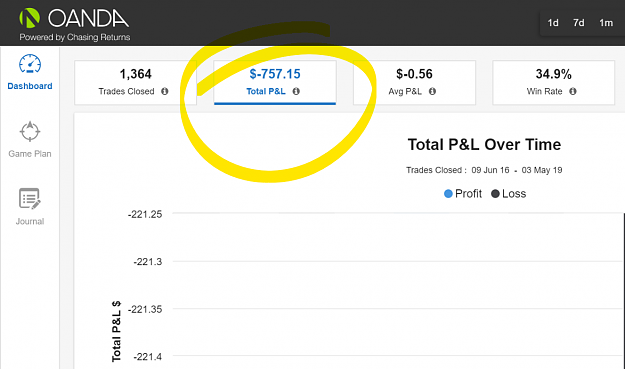

I do respect that you share some original ideas about trading but without stop loss is just a recipe for disaster.

First thing in trading is to manage the losses, which you don’t.

If you know where to enter and where to take profit, why don’t you know where to exit with a loss ?

LDFX Trading Ltd