Excellent clarification of the stops Scott ....

-----------

now we might see Math Man vs Magic Man

Place your bets gentleman !

-----------

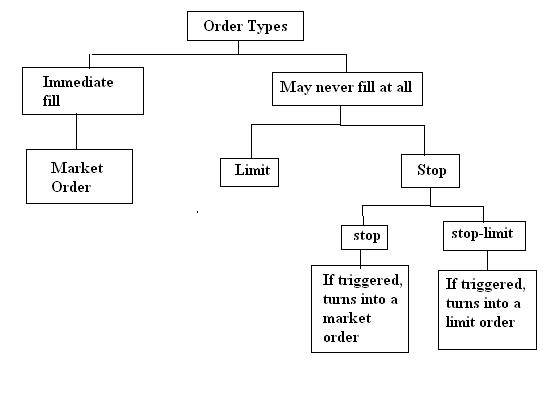

I guess not many people understand the stop orders causing many to enter market using astronomy instead of stop orders

-----------

now we might see Math Man vs Magic Man

Place your bets gentleman !

-----------

I guess not many people understand the stop orders causing many to enter market using astronomy instead of stop orders