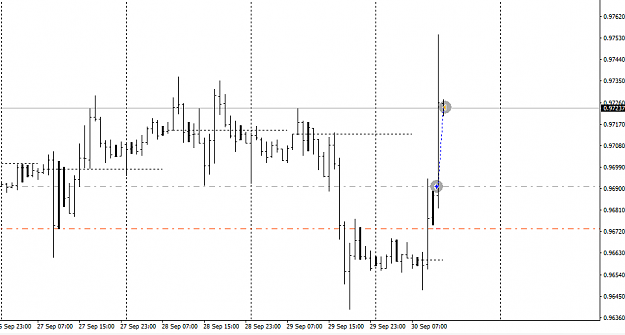

DislikedHi Guys Nice to see this thread has been given a new life. I was looking for a reliable "inside bar alert" indicator and found this to be very useful. It sends me a message to my iphone. No excuse for missing them now!It also draws entry and exit prices should you want to use them. Good trading {file} Credit to: http://www.acbforextrading.com/ for the FREE indicator

Ignored

cheers

"...Look for 5:1 RR. I can be wrong 8/10 time yet I'm not gonna lose" PTJ