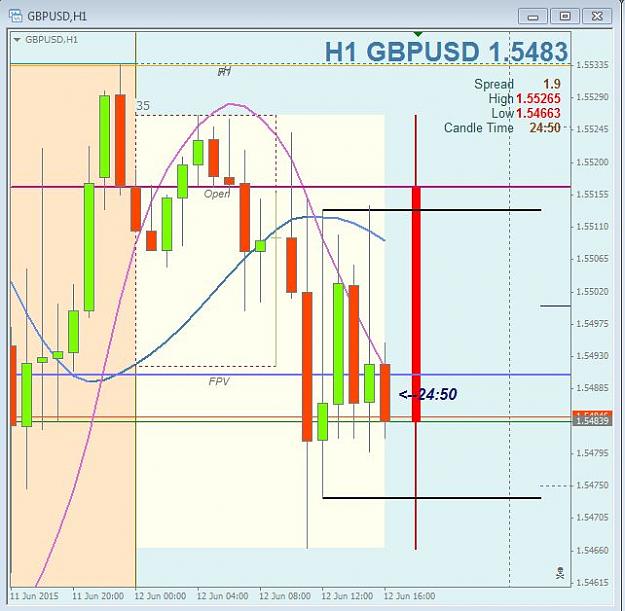

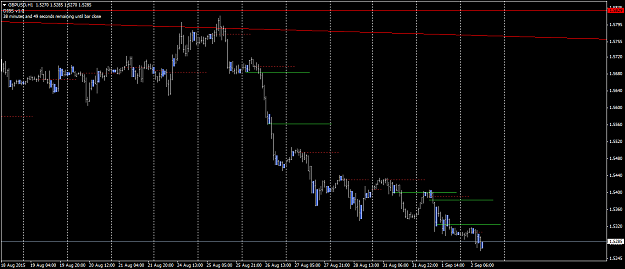

DislikedIve come back to it after some time away from trading, i made great pips using the exact outlay of PETER CROWN. i also found with my experience that a lot of the time you had to cut and run with the pips each day, so of now im using 20 period ATR with itIgnored

what ever it takes