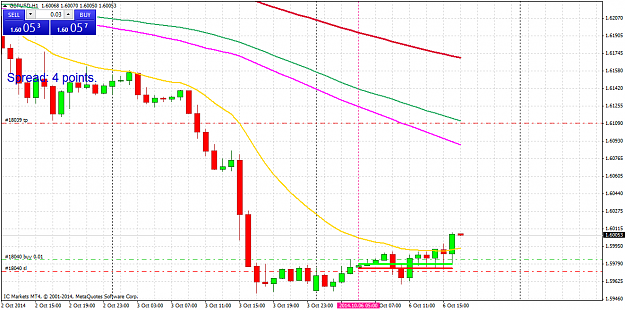

got into GU too.

How I place my tp and divide my size into 4 parts

-2/4 Risk 1 to 1

-1/4-SMA20, 72 and 90 on 1 hour, 4Hr and Daily!

-1/4 let is run as far as it can

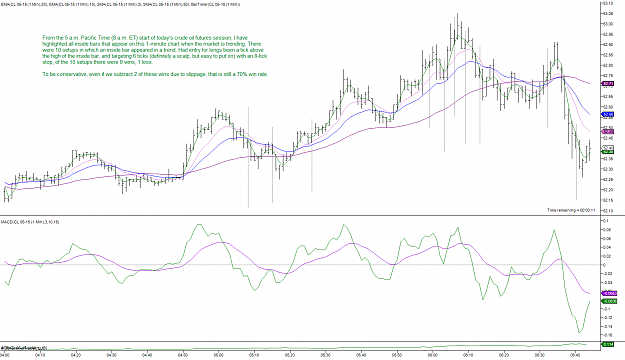

How I place my tp and divide my size into 4 parts

-2/4 Risk 1 to 1

-1/4-SMA20, 72 and 90 on 1 hour, 4Hr and Daily!

-1/4 let is run as far as it can