Hi to all!!!!!

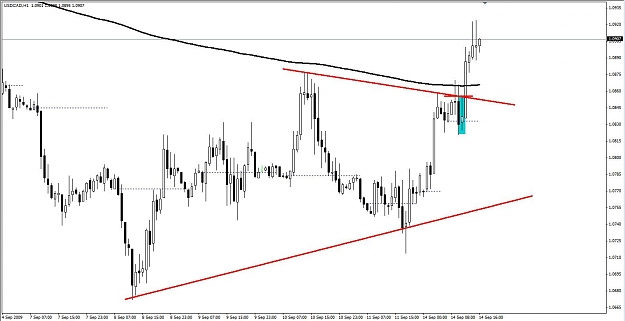

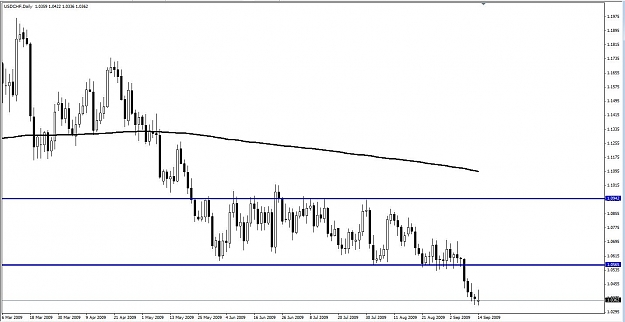

My today's two trades with GBP and JPY... I let it run now with B/E...

I trade without half profit take. I move STOP to B/E when the price moves form breakout point so large as was IB... (Sorry for english).

These trades I will hold on with 80 and 90 SMA's (may be some days).

P.S. I trade with live account!!!

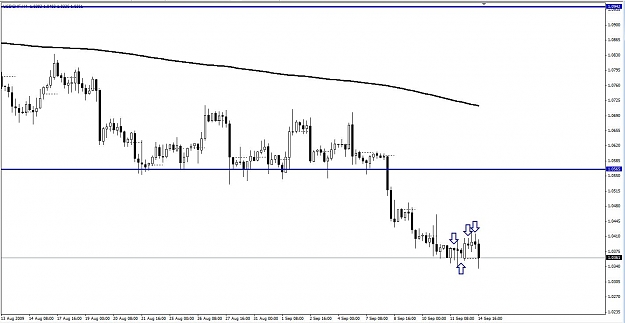

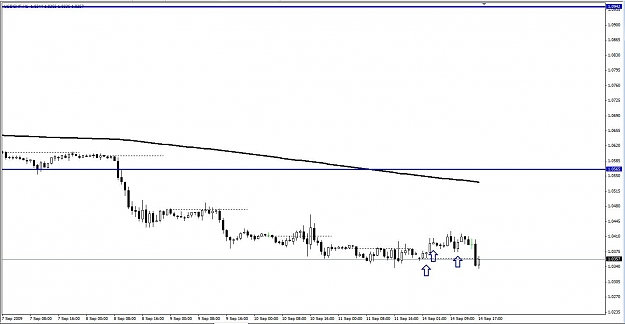

My today's two trades with GBP and JPY... I let it run now with B/E...

I trade without half profit take. I move STOP to B/E when the price moves form breakout point so large as was IB... (Sorry for english).

These trades I will hold on with 80 and 90 SMA's (may be some days).

P.S. I trade with live account!!!