Hi Everyone. Iíve been a long time lurker on FF and since Iíve finally reached some level of success in my trading I thought it would be a nice thing to share some of my findings with the rest of the community.

The ideas of this system were given to me by my sistersí long time ex, a former hedge fund tech who I happened to come across in a bar about a year ago. He told me that heíd been doing some research on correlated movements of currency pairs and that his former employers were making a killing in the forex market with strategies based on his work. I was a bit intrigued by the thought of creating a strategy which success was based, not on the direction of one pairs movement, but rather the correlation between two currency pairs. After doing some research of my own and reading up on a lot of the mathematical theories behind correlation trading Iíve managed to put together a strategy that has delivered some remarkable performance over the last couple of months. Last month I was up 34 % on my account with very few draw downs.

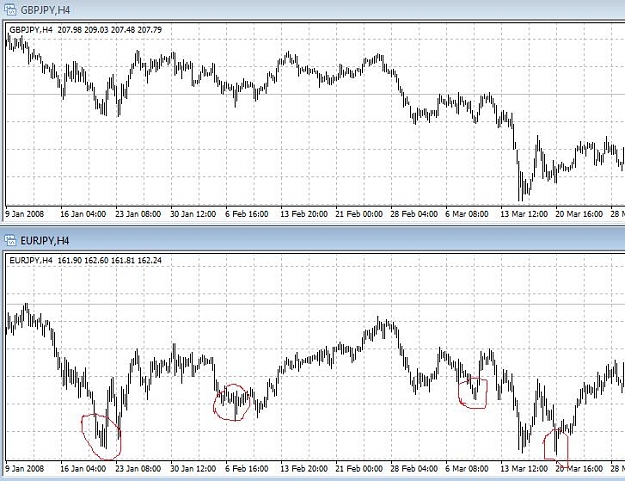

The idea is quite simple and tries to mimic the so called pairs trading done on stocks by many major StatArb hedge funds. I look at two currency pairs that seem to have a correlated price movement in the past like for example EURJPY and GBPJPY (see chart 1).

When the spread between the two pairs deviates from their past behavior I simply sell the over performer and buy the underperformer. In this case I would sell GBPJPY and buy EURJPY. This way I have isolated the success of my position to the spread between these two pairs and hedged out the risk of the market in general moving in either way. As long as the spread between the two pairs shrinks back to normal Iíll make money without regard to the market direction.

I have found that exotic pairs like the Nordic countries SEK/NOK/DKK seem very good when using this strategy. But Iíve also had some great success with GBPJPY and EURJPY and I have recently been looking at pairs including oil, silver and gold which look very promising but I have yet to start trading these.

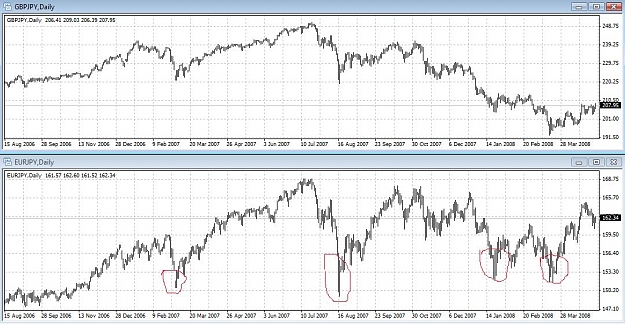

The system can be used both for long term and short term trading depending on the amount of correlation between the pairs traded. If you have a look at the daily chart of GBPJPY vs. EURJPY (Chart 2) you can see that there have been some great opportunities over the last two years with long term trading these pairs.

I hope that some of you will find this strategy useful and I will continue posting here with more information on the strategy. If you have questions I am happy to answer them or suggestions on how the strategy can be made even more profitable.

Best of trading luck to all of you. /Zeusjoes

The ideas of this system were given to me by my sistersí long time ex, a former hedge fund tech who I happened to come across in a bar about a year ago. He told me that heíd been doing some research on correlated movements of currency pairs and that his former employers were making a killing in the forex market with strategies based on his work. I was a bit intrigued by the thought of creating a strategy which success was based, not on the direction of one pairs movement, but rather the correlation between two currency pairs. After doing some research of my own and reading up on a lot of the mathematical theories behind correlation trading Iíve managed to put together a strategy that has delivered some remarkable performance over the last couple of months. Last month I was up 34 % on my account with very few draw downs.

The idea is quite simple and tries to mimic the so called pairs trading done on stocks by many major StatArb hedge funds. I look at two currency pairs that seem to have a correlated price movement in the past like for example EURJPY and GBPJPY (see chart 1).

When the spread between the two pairs deviates from their past behavior I simply sell the over performer and buy the underperformer. In this case I would sell GBPJPY and buy EURJPY. This way I have isolated the success of my position to the spread between these two pairs and hedged out the risk of the market in general moving in either way. As long as the spread between the two pairs shrinks back to normal Iíll make money without regard to the market direction.

I have found that exotic pairs like the Nordic countries SEK/NOK/DKK seem very good when using this strategy. But Iíve also had some great success with GBPJPY and EURJPY and I have recently been looking at pairs including oil, silver and gold which look very promising but I have yet to start trading these.

The system can be used both for long term and short term trading depending on the amount of correlation between the pairs traded. If you have a look at the daily chart of GBPJPY vs. EURJPY (Chart 2) you can see that there have been some great opportunities over the last two years with long term trading these pairs.

I hope that some of you will find this strategy useful and I will continue posting here with more information on the strategy. If you have questions I am happy to answer them or suggestions on how the strategy can be made even more profitable.

Best of trading luck to all of you. /Zeusjoes

All their pips are belong to us.