Hi, I did a manual backtest on this system, it looks to be very successful although I only went back about 10 days. This is because my charts only went back 10 days on the 5 min chart.

I had an oppurtunity this morning and I took the trades so far so good.

There could be many versions of this It is not fully developed. I am open to ideas.

ok lets get started.

Time frame : 5min only (for the moment do not go higher or lower timframes this usuallly leads to confusion only)

Pairs: AUDUSD, AUDCHF, NZDJPY

Why these pairs you might ask. Simply these pairs are positively correlated from year all the way to 1hr.

We should check every week for correlation to see if any of the pairs are way out of correlation(this might be a way to trade that pair as a mean reversion)

Indicators: 50 sma , 200 sma

Lots: we enter 3 different lots per pair(it is up to the person to risk whatever they want, I divide my full buying power into 9. eg. $1000 x 50(leverage) =50000/9=5555 per entry.)

Entry:long(reverse for shorts): If any 2 of the 3 pairs have their 50 sma cross over 200 sma from bottom to up we enter a buy trade for all 3 pairs.

we should have 3 different entries long per pair. So total entries would be 9.

SL: Our hard stop loss for all entries will be 15 pips +spread.

TP: Our tp for 1 entry will be 20 pips;(at this point we will bring the remaining 2 entries to breakeven + spread)

One of the remaining 2 entries will have a Tp of 50 pips. But the other one we wil trail.

The one entry we wil trail by following the bottom of higher lows.(reverse is for shorts)

If at any time price touches the 200 sma or 50 sma crosses back over 200 sma the reamining 2 entries will be closed.

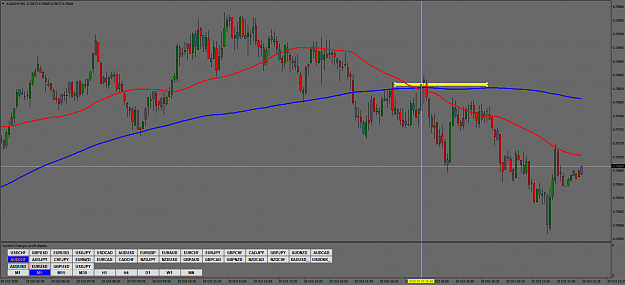

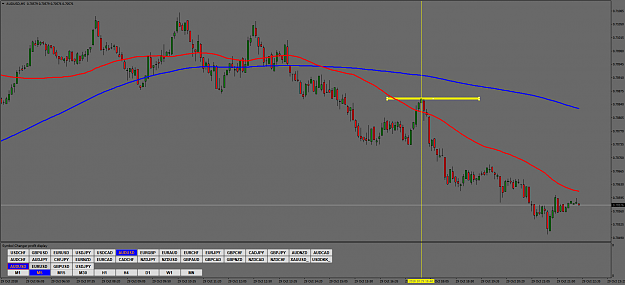

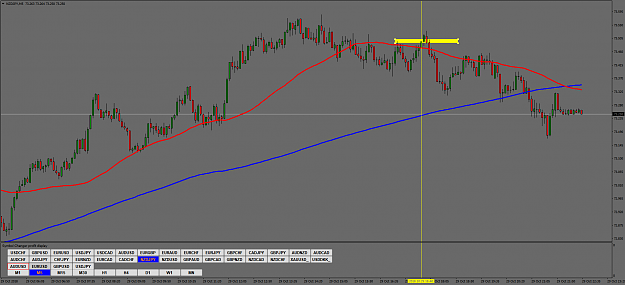

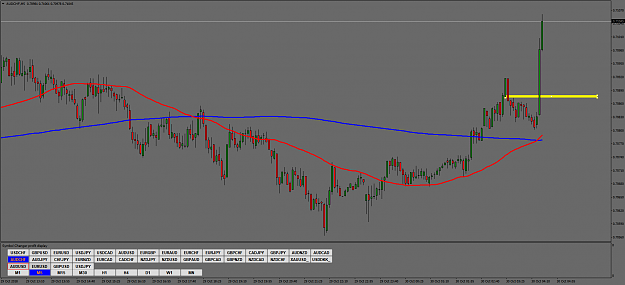

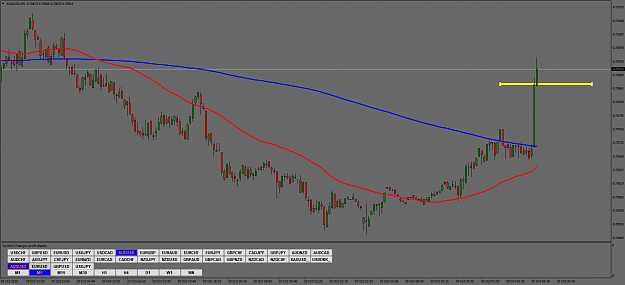

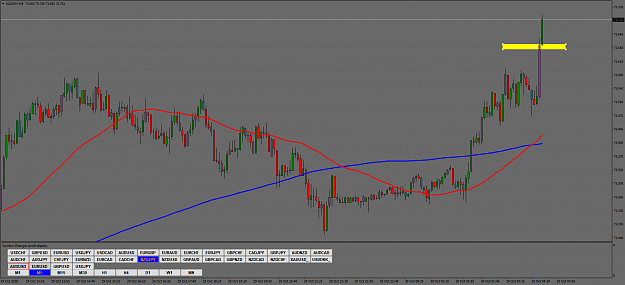

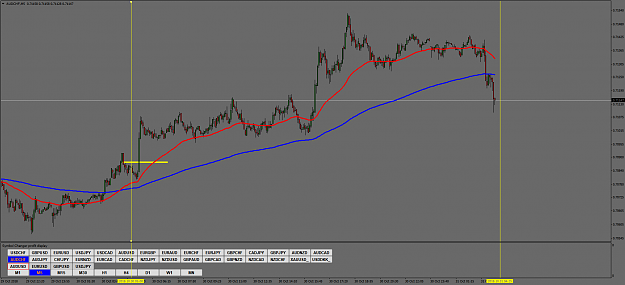

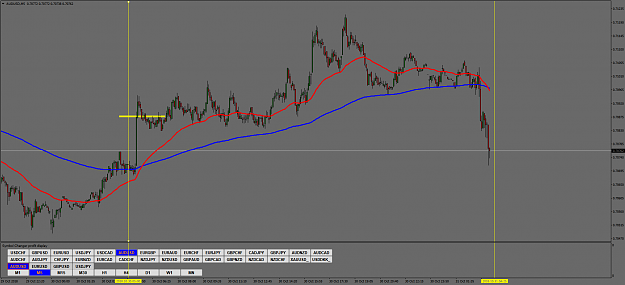

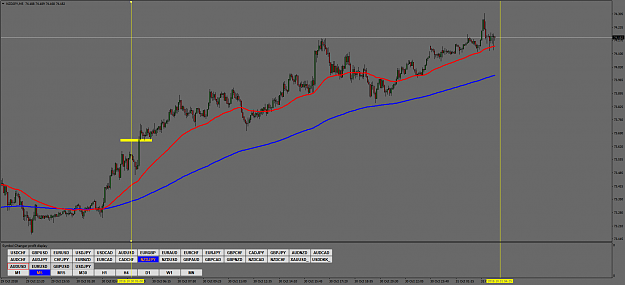

Here are the trades I took this morning:

Some of them still open some closed with profit already.

P.S. I'm thinking of 4 entries per pair, the fourth entry we will bring to breakeven after 20 pips like the rest and only exit when 50 sma crosses back 200 sma. Sometimes this leads to about 90 pips but more often the highest price goes before smas cross is around 50 pips.

I had an oppurtunity this morning and I took the trades so far so good.

There could be many versions of this It is not fully developed. I am open to ideas.

ok lets get started.

Time frame : 5min only (for the moment do not go higher or lower timframes this usuallly leads to confusion only)

Pairs: AUDUSD, AUDCHF, NZDJPY

Why these pairs you might ask. Simply these pairs are positively correlated from year all the way to 1hr.

We should check every week for correlation to see if any of the pairs are way out of correlation(this might be a way to trade that pair as a mean reversion)

Indicators: 50 sma , 200 sma

Lots: we enter 3 different lots per pair(it is up to the person to risk whatever they want, I divide my full buying power into 9. eg. $1000 x 50(leverage) =50000/9=5555 per entry.)

Entry:long(reverse for shorts): If any 2 of the 3 pairs have their 50 sma cross over 200 sma from bottom to up we enter a buy trade for all 3 pairs.

we should have 3 different entries long per pair. So total entries would be 9.

SL: Our hard stop loss for all entries will be 15 pips +spread.

TP: Our tp for 1 entry will be 20 pips;(at this point we will bring the remaining 2 entries to breakeven + spread)

One of the remaining 2 entries will have a Tp of 50 pips. But the other one we wil trail.

The one entry we wil trail by following the bottom of higher lows.(reverse is for shorts)

If at any time price touches the 200 sma or 50 sma crosses back over 200 sma the reamining 2 entries will be closed.

Here are the trades I took this morning:

Some of them still open some closed with profit already.

P.S. I'm thinking of 4 entries per pair, the fourth entry we will bring to breakeven after 20 pips like the rest and only exit when 50 sma crosses back 200 sma. Sometimes this leads to about 90 pips but more often the highest price goes before smas cross is around 50 pips.