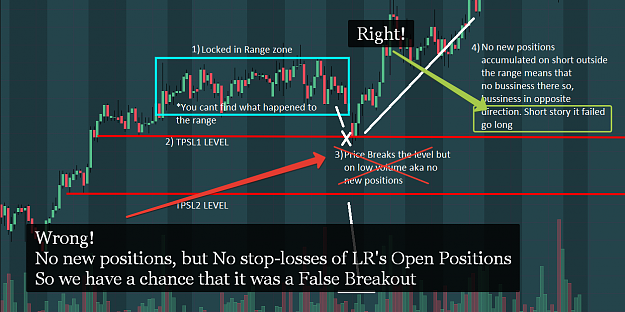

Disliked{quote} I looked your marked charts and could not understand logic or relate logic of LRA on those charts ("buy here"). Kindly describe the reasons of LRA when you post chart so I unfamiliar with LRA method can learn. {image}Ignored

Don't be a Lucky-trader! Just make cause-and-effect trades!

1