Hello everyone!

I would like to give you a short description of my trading methodology that was giving me substantial returns for over a decade.

I started trading in the summer of 2006 and indulged everything related to trading with fun and determination. Tried many approaches, read tons of books about strategies and the economy in general. Luckily it didn't take me long to grasp that all major price moves in international capital markets are driven by either anticipation and/or surprise. Big traders follow what central banks are doing, central banks follow the development of inflation and employment data.

Since these agencies and corporations command almost all of the available liquidity in the markets, I thought to myself, wouldn't it be logical to try to follow their actions and try to get a piece of the cake? I started studying to see what events are really important to these traders and to the economy in general. I tried to understand what prerequisites needed to be there in order for the market to go into a certain direction.

I saw how inflation data was really THE big deal before and right after the market crash in 2008, how stock indices, commodities, and currencies went ballistic following readings in inflation. I could not understand how the majority of retail traders were ignoring these data points. The big moves were right there on the trading screens and yet people did not care. I remember one day in 2008 I had lunch with another trader and asked him what he thought about the upcoming uk interest rate decision. He was a technical trader and said he was not watching it since it was not important. When the Bank of England cut rates, the Pound was slaughtered and my friend the technical trader left in awe. He was not prepared for a move that was crushing right through all technical support levels.

That is when I realized, people are quite naive when it comes to trading. They'd rather trust some indicator or price level than what the big money was doing. The only way to extract profits from the markets, I thought, was to accept that the market has to move either up or down, driven by accumulated buying or selling of Dollars, Euros, Francs, Yen and Pounds.

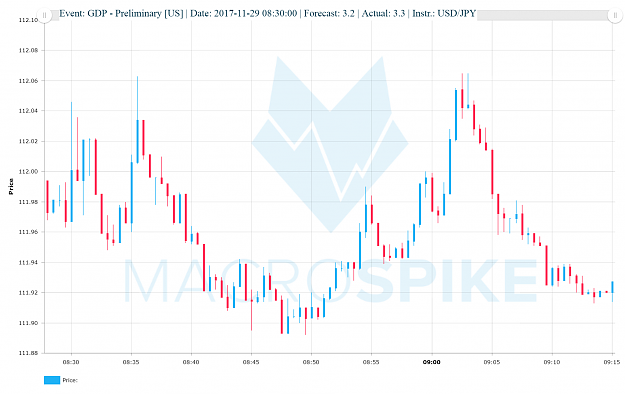

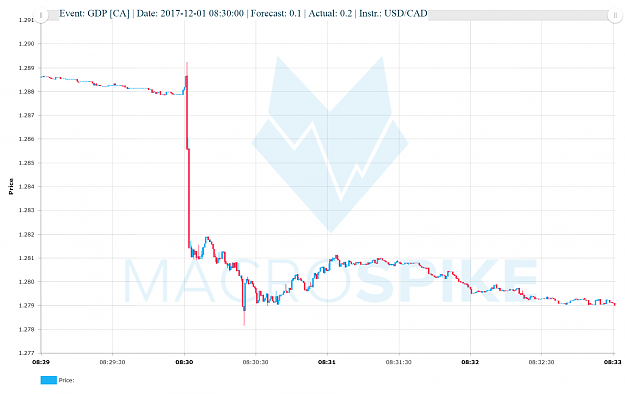

During all these years I had several approaches to trading. Some ideas were quite unique, others a derivative of a former one. But, they all had one thing in common They were based on economic data and analysis of the macroeconomy. I subscribed to a fast news feed and constructed my trading strategies around these pieces of newly-available information. Whenever a news event was deviating from what economists predicted, I had an entry signal. Having access to a low-latency newsfeed, I entered in real-time. The only part of the trading strategy that I had to adapt was the exit. Here I even used a bit of technical analysis. And I still do. But not for the entry, just for the exit.

I will try to do my best to post trading ideas and actual trades that I think are interesting, so I can connect with you and learn from you, and you from me.

I would like to give you a short description of my trading methodology that was giving me substantial returns for over a decade.

I started trading in the summer of 2006 and indulged everything related to trading with fun and determination. Tried many approaches, read tons of books about strategies and the economy in general. Luckily it didn't take me long to grasp that all major price moves in international capital markets are driven by either anticipation and/or surprise. Big traders follow what central banks are doing, central banks follow the development of inflation and employment data.

Since these agencies and corporations command almost all of the available liquidity in the markets, I thought to myself, wouldn't it be logical to try to follow their actions and try to get a piece of the cake? I started studying to see what events are really important to these traders and to the economy in general. I tried to understand what prerequisites needed to be there in order for the market to go into a certain direction.

I saw how inflation data was really THE big deal before and right after the market crash in 2008, how stock indices, commodities, and currencies went ballistic following readings in inflation. I could not understand how the majority of retail traders were ignoring these data points. The big moves were right there on the trading screens and yet people did not care. I remember one day in 2008 I had lunch with another trader and asked him what he thought about the upcoming uk interest rate decision. He was a technical trader and said he was not watching it since it was not important. When the Bank of England cut rates, the Pound was slaughtered and my friend the technical trader left in awe. He was not prepared for a move that was crushing right through all technical support levels.

That is when I realized, people are quite naive when it comes to trading. They'd rather trust some indicator or price level than what the big money was doing. The only way to extract profits from the markets, I thought, was to accept that the market has to move either up or down, driven by accumulated buying or selling of Dollars, Euros, Francs, Yen and Pounds.

During all these years I had several approaches to trading. Some ideas were quite unique, others a derivative of a former one. But, they all had one thing in common They were based on economic data and analysis of the macroeconomy. I subscribed to a fast news feed and constructed my trading strategies around these pieces of newly-available information. Whenever a news event was deviating from what economists predicted, I had an entry signal. Having access to a low-latency newsfeed, I entered in real-time. The only part of the trading strategy that I had to adapt was the exit. Here I even used a bit of technical analysis. And I still do. But not for the entry, just for the exit.

I will try to do my best to post trading ideas and actual trades that I think are interesting, so I can connect with you and learn from you, and you from me.