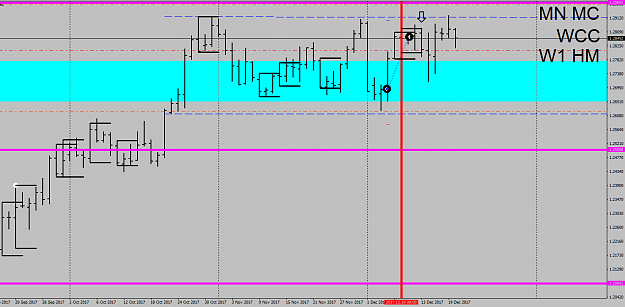

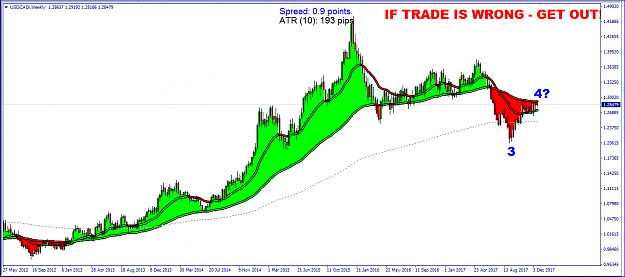

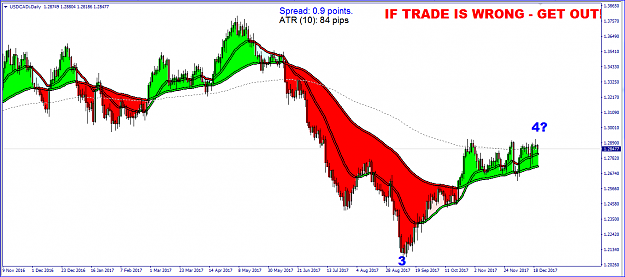

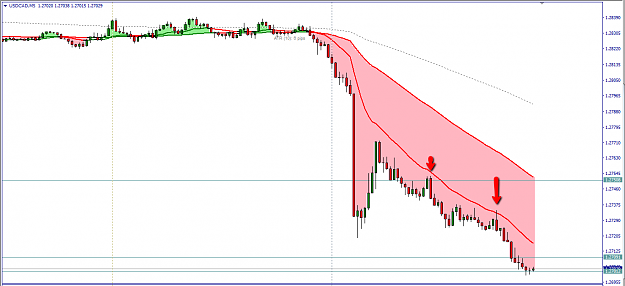

DislikedHello everyone, Here's a potential trade I think is pretty simple for USD/CAD. I know I said in a few posts back I was not doing WCC analysis, but I read a bit more about them and I saw this opportunity so I thought I'd share it anyways. As strat pointed out in a previous post, the pair is currently working on it's 8th week being trapped inside the WCC (delineated by the dashed blue lines). So, on my data, there's a SS at the WCC resistance on the daily. Enter short 10 pips below low of SS candle. TP at the support level I have drawn at around 1.268....Ignored

1