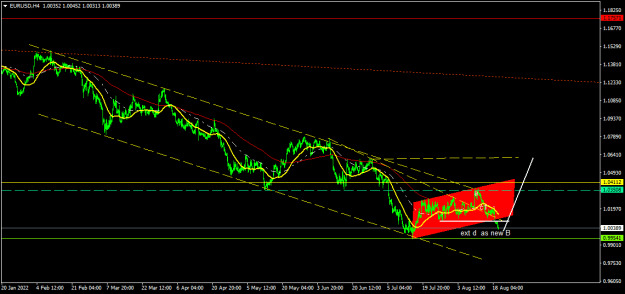

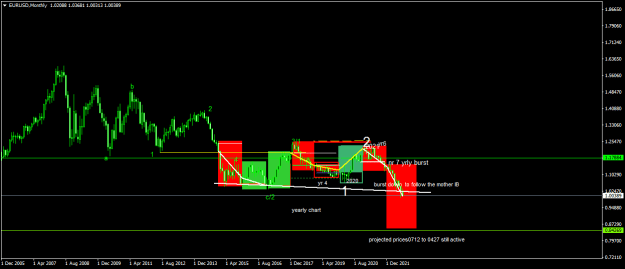

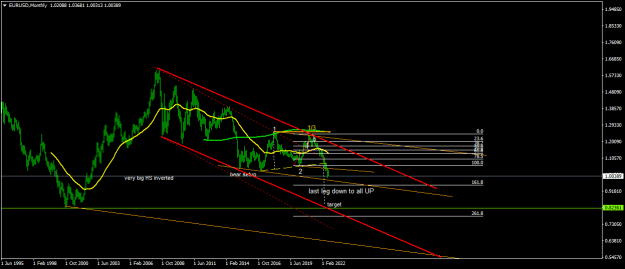

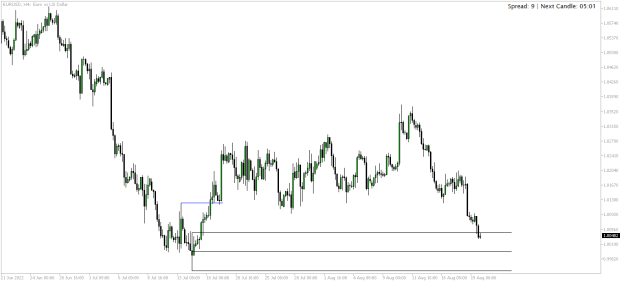

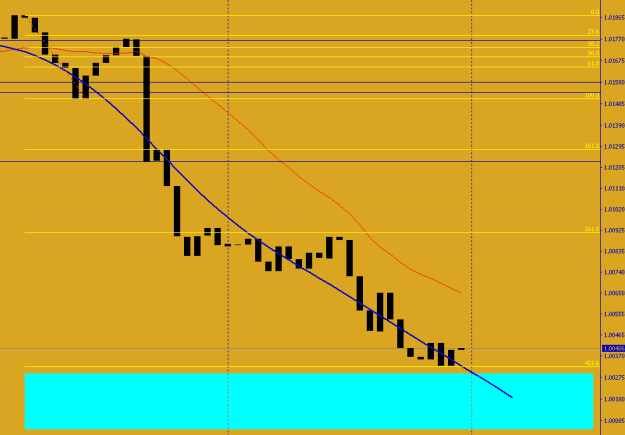

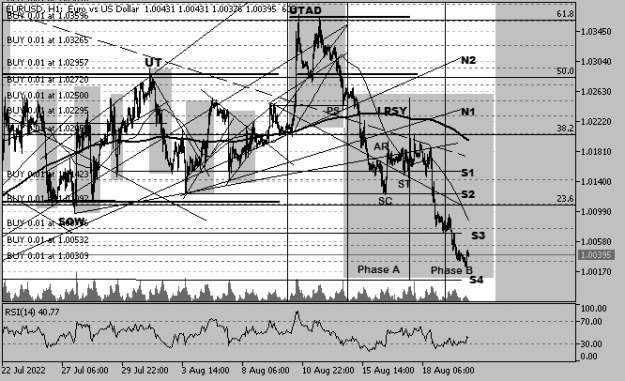

EURUSD drop from 1.0369 may stop to rest at the lower demand area, for a test of 1.0203 below the monthly pivot level. My attention will be at the red trendline, but the newly (grey) didn't formed yet, only a new lower low will make it count, but its interesting to look at price action if, it moves around.

Looking for profitable short term trades ...|