I've been meaning to start a new purely Dax discussion thread for a while, so here it is. This thread is not meant to replace any other existing Dax thread, merely to stand on its own as a thread for Dax traders who want to check their levels and analysis with mine or others, or discuss points that are relevant.

I have been trading Dax consistently for several years now, and like it for its volatility, big range, and low spread, especially important when using a stop loss rarely wider than 15-20 pips, which I am able to do by timing my entries off of a 20 second chart. I am a multi-time frame trader, using 20sec, 1m, 5m, 20m, H1 and H4 charts, all of which I have open in front of me at all times using six monitors. On days when I am not trading Dax, I am usually trading GJ, easily my favourite forex pair.

If anyone wishes to post trades, then can I ask that they are backed up with an explanation and perhaps a chart, because the reason this is on the Discussion thread ( now moved by ff moderators to Stocks and Commodities ) and not an interactive one is because I want to discourage the buy here/sell there type post, which is of little value to others unless it is backed up with a rationale for the trade. Personally, I do not have the time or inclination for posting my trades, so I will refrain from it. What I will do is post my ideas on the likely daily direction when I have it, S&R levels, and anything else throughout the day that I see as important information for Dax traders. I encourage others to do the same, agree with me, disagree with me, post your own levels and analysis, whatever, as long as it is constructive and objective. My focus will be on intra-day trading, so I will rarely post any TA that is further out than the next 24 hours, though I will occasionally refer to longer term levels of support and resistance if I see them as important.

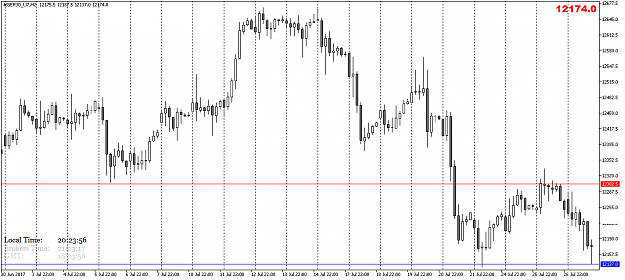

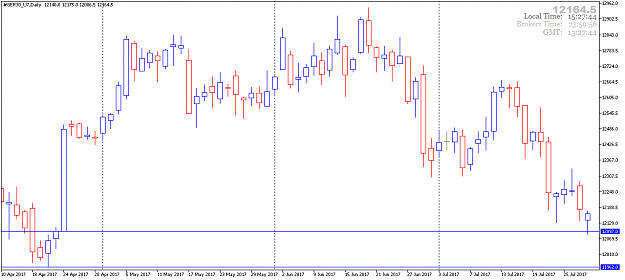

For starters today, I see Dax carrying pretty strong down momentum so far today, but potential support is not far beneath, which probably explains why it keeps dipping and coming back. The final support I have today is S2 @ 12,185. If that breaks , then we are into new lows for the week unless it double bottoms. Upside is tricky to say at the moment, so I'll leave that alone, though CP @ 287 is a possibility if it does manage to reverse north during the NY session. DFib levels on the downside today are 61.8 @ 12,218, which we just hit, and 76.4% @ 188, just above S2.

Just one thing I ask, if you do post charts, which is great, no problem there, but keep it to one or two, as there's no bigger turn off than someone who posts ten of their own charts in a row, bearing in mind that for most of us, another trader's charts can be pretty meaningless when they bear absolutely no resemblance or relation to our own.

Good, let's see how we get on.

I have been trading Dax consistently for several years now, and like it for its volatility, big range, and low spread, especially important when using a stop loss rarely wider than 15-20 pips, which I am able to do by timing my entries off of a 20 second chart. I am a multi-time frame trader, using 20sec, 1m, 5m, 20m, H1 and H4 charts, all of which I have open in front of me at all times using six monitors. On days when I am not trading Dax, I am usually trading GJ, easily my favourite forex pair.

If anyone wishes to post trades, then can I ask that they are backed up with an explanation and perhaps a chart, because the reason this is on the Discussion thread ( now moved by ff moderators to Stocks and Commodities ) and not an interactive one is because I want to discourage the buy here/sell there type post, which is of little value to others unless it is backed up with a rationale for the trade. Personally, I do not have the time or inclination for posting my trades, so I will refrain from it. What I will do is post my ideas on the likely daily direction when I have it, S&R levels, and anything else throughout the day that I see as important information for Dax traders. I encourage others to do the same, agree with me, disagree with me, post your own levels and analysis, whatever, as long as it is constructive and objective. My focus will be on intra-day trading, so I will rarely post any TA that is further out than the next 24 hours, though I will occasionally refer to longer term levels of support and resistance if I see them as important.

For starters today, I see Dax carrying pretty strong down momentum so far today, but potential support is not far beneath, which probably explains why it keeps dipping and coming back. The final support I have today is S2 @ 12,185. If that breaks , then we are into new lows for the week unless it double bottoms. Upside is tricky to say at the moment, so I'll leave that alone, though CP @ 287 is a possibility if it does manage to reverse north during the NY session. DFib levels on the downside today are 61.8 @ 12,218, which we just hit, and 76.4% @ 188, just above S2.

Just one thing I ask, if you do post charts, which is great, no problem there, but keep it to one or two, as there's no bigger turn off than someone who posts ten of their own charts in a row, bearing in mind that for most of us, another trader's charts can be pretty meaningless when they bear absolutely no resemblance or relation to our own.

Good, let's see how we get on.